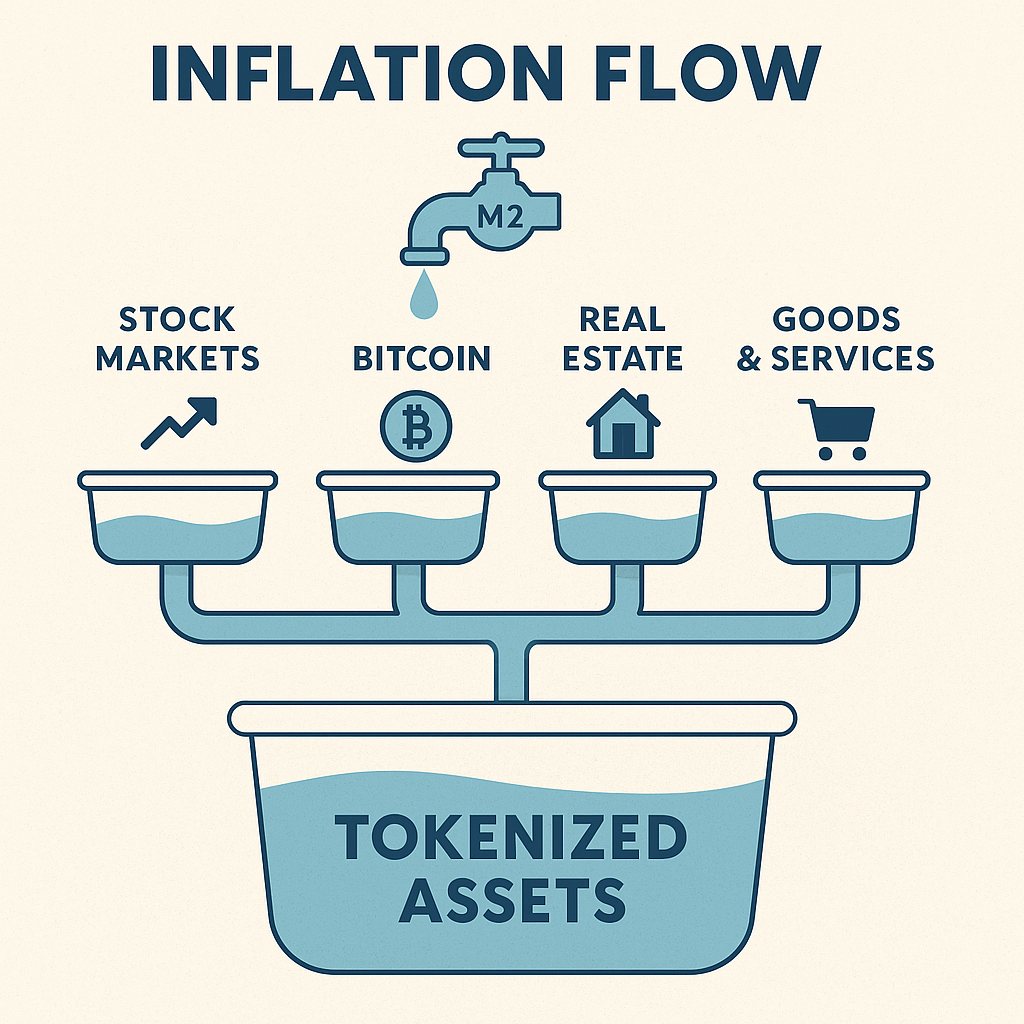

Picture inflation not as an abstract economic number, but as water flowing through pipes into different sinks.

The main tap—what we call Global M2—is how much money exists in the world. Every time central banks print, stimulate, or ease credit conditions, they turn the tap.

Now the question is: Where does all that liquidity go?

The Great Flood of Money

Over the past decade, the world’s M2 supply (the total global money stock) has exploded. When the tap is open, liquidity rushes into whichever sink can absorb it. But these sinks are not equal; some are deeper, faster-draining, or more accessible than others.

Let’s look at the current ones:

- Stock Markets: The classic sink. When interest rates are low, capital floods equities as investors hunt for yield.

- Bitcoin and Crypto: The new-age sink. High volatility but infinite scalability — it absorbs digital trust capital.

- Real Estate: The old stalwart. It soaks up trillions but is leaky with friction—slow, illiquid, and localized.

- Goods and Services: The everyday sink. When too much money chases too few goods, you see it here as price inflation.

The key insight? Inflation isn’t about money printing alone.

It’s about where that printed money ends up.

The Coming of a Fifth Sink — Real World Assets on Chain

There’s a new, deeper basin forming: Real World Assets (RWAs).

Tokenization—turning real things like real estate, commodities, and debt into digital tokens—creates an entirely new sink for liquidity. And this one has almost no friction.

- A tokenized property can be bought in seconds.

- A gold-backed stablecoin can move across borders instantly.

- A fractionalized solar farm can attract retail and institutional investors simultaneously.

When assets become programmable, the pipes widen. Money doesn’t just trickle through financial intermediaries anymore—it flows directly to opportunity.

That’s the breakthrough. Tokenization doesn’t just innovate finance—it democratizes access to capital formation itself.

200 Trillion Reasons Why It Matters

Today, roughly $200 trillion worth of real-world assets—from property and bonds to commodities—are poised to move on-chain.

Once that happens, liquidity will find this new sink irresistibly attractive.

Why? Because:

- Frictionless transactions mean faster velocity of money.

- Transparent settlement means reduced trust costs.

- Global accessibility means wider investor participation.

When capital can move without borders or brokers, inflation finds a new equilibrium.

Instead of inflating goods and housing prices, liquidity will flow into tokenized productivity — into digital representations of real value.

A New Monetary Plumbing System

Think of it this way:

- Central banks open the tap.

- AI-driven investors direct the flow.

- Tokenized infrastructure becomes the sink that absorbs it efficiently.

The result is a more fluid, transparent, and inclusive monetary ecosystem.

Inflation won’t vanish—it will simply redistribute through smarter pipes.

And those who understand this shift early won’t just be watching the flow — they’ll be building the next generation of capital markets that channel it.

Closing Thought

We are standing at the dawn of the Tokenized Liquidity Era.

When $200 trillion of real assets flow into programmable markets, we will witness not the end of inflation—but the re-engineering of how it moves through the global economy.

Money, like water, always seeks the path of least resistance.

Tokenization just built it a brand-new riverbed.

Leave a Reply