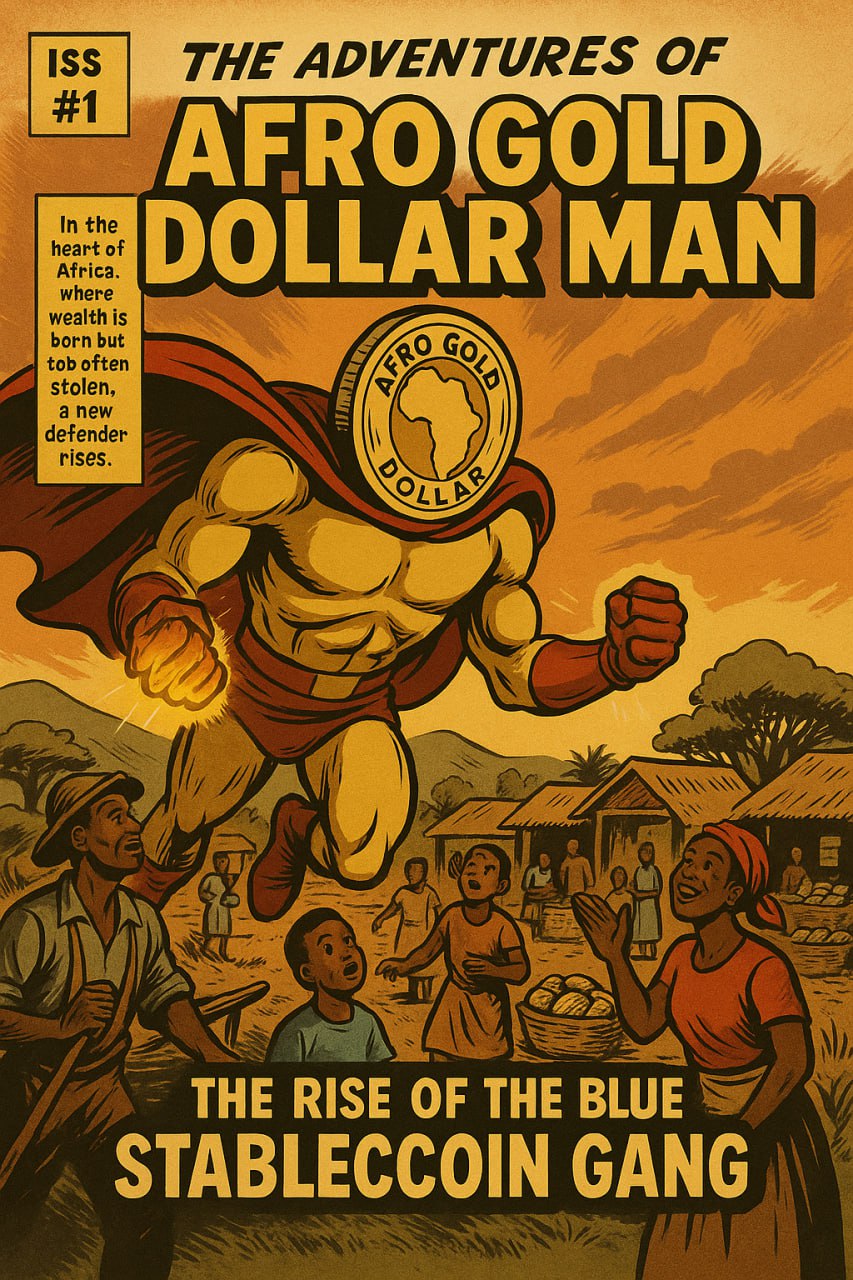

Building the Afro Gold Dollar Stablecoin and Gold Token

Maybe it was designed this way. It’s very easy to blame the victim, but that ignores the deeper truth: when you have economic systems that are extractive by design, wealth doesn’t stay where it’s created. It flows out.

Africans and Russians both enjoy luxury. The key difference is that no one is extracting wealth from Russia in the same way Africa has been drained for centuries. Africa isn’t poor—it’s been pillaged.

Looking at the Core Issue

It’s tempting to scold consumers: “stop buying luxury goods, stop wasting money on imports.” But that’s not the root cause. I’ve worked on Bay Street building financial systems for banks and insurance companies. I’ve seen how wealth is preserved and protected through infrastructure—systems designed to lock in generational prosperity. Africa, in contrast, has been left with systems that do the opposite: extract value and send it abroad.

We have to address this imbalance first. Without fixing the pipes of the system, it doesn’t matter how frugally people live; the leak is still there.

The Numbers Don’t Lie

Over $90 billion flows into Africa every year through remittances—one of the biggest lifelines from the Diaspora. But nearly the same amount flows straight back out in the form of luxury purchases like Range Rovers and Hennessy. That isn’t just individual choice. It’s the consequence of economic structures that don’t circulate wealth within the continent.

Imagine if even half of those billions stayed in Africa, reinvested in productive assets, startups, infrastructure, and community. The multiplier effect would be transformative.

A New World Order, An African Leapfrog

The current economic order is fading. Debt-based systems in the West are fraying. New technologies are rewriting the rules. This is Africa’s moment to leapfrog the old model—just as mobile money leapfrogged landline banking—and build something designed for us, not against us.

Ndeipi is building these new systems. Together with companies like Ubuntu Tribe, which provides gold tokens, and our Believe In Unity Banking App, we are creating financial rails that preserve wealth inside Africa and across the Diaspora. These tools make it possible to save in gold-backed tokens, transact in stablecoins, and move money without watching it vanish into extractive channels.

Building a Commodity Exchange

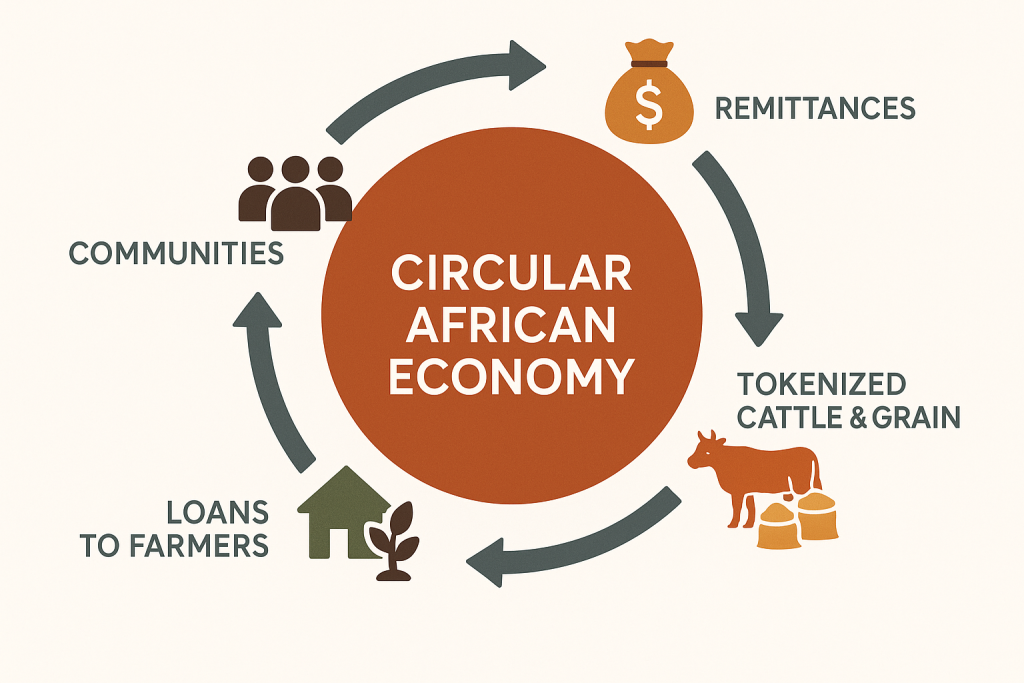

The next step is deeper: we are building a commodity exchange where real African assets—cattle, grain, and other staples—are tokenized.

- A farmer with ten cattle can tokenize them into secure digital assets, backed by smart contracts. Those tokens can be used as collateral to access cheap loans.

- Grain harvests can be tokenized too, turning what was once illiquid produce into a tradable, liquid financial asset. Farmers no longer need to wait for a middleman to set the price—they can access transparent markets directly.

Because we control the gold reserves and the stablecoin infrastructure, these loans don’t come with predatory interest rates. Instead of borrowing at 50% from loan sharks, farmers in villages can access affordable credit, secured by their own tokenized cattle or grain. This is how wealth starts circulating locally, instead of draining outward.

Beyond Blame

Yes, restraint matters. Yes, luxury spending can be reduced. But that’s not the reason for Africa’s current situation. The reason lies in the design of the system itself. When we stop blaming the victim and start redesigning the architecture, we unlock a new future.

This is not about nostalgia for what could have been. It’s about seizing what is possible right now. A circular African economy, powered by blockchain, backed by real assets, and connected to the Diaspora, is already being built.

Maybe we are on the same page after all: Africa doesn’t need to play by the old rules. It’s time to write new ones.

Leave a Reply