When Bitcoin first appeared in 2009, it was dismissed as a curiosity. Today, its fixed supply of 21 million coins has become a trillion-dollar story of scarcity, belief, and network effects.

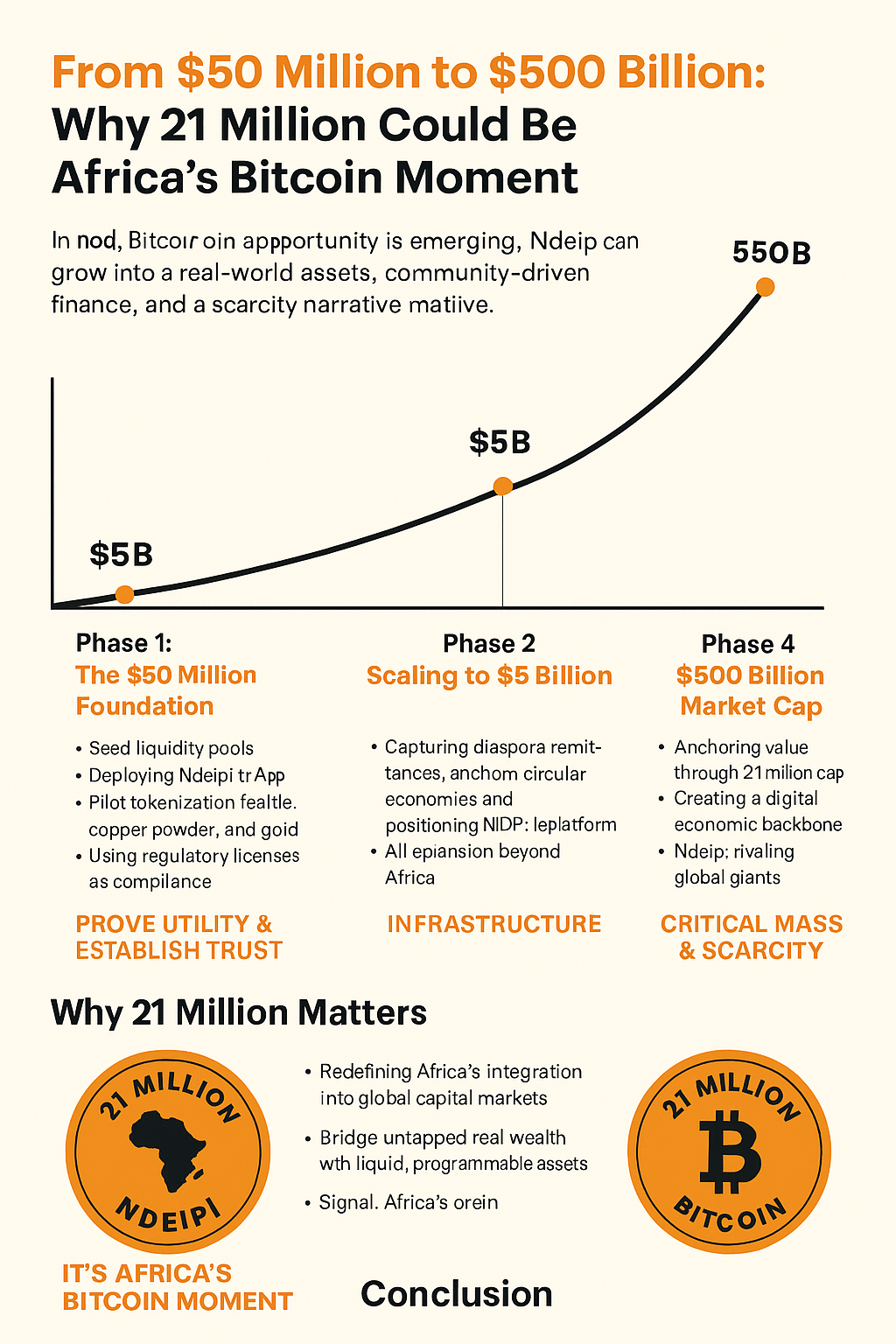

Now, a similar opportunity is emerging in Africa. With an initial $50 million raise, Ndeipi has the blueprint to grow into a $500 billion ecosystem by combining the power of real-world assets, community-driven finance, and a clear scarcity narrative. This is not a clone of Bitcoin — it’s Africa’s own moment of financial sovereignty.

Phase 1: The $50 Million Foundation

The journey begins with building liquidity and trust. With $50 million, Ndeipi can:

- Seed liquidity pools for the Afro Gold Dollar Stablecoin.

- Deploy the Ndeipi App across Zambia, Zimbabwe, and South Africa for payments, tokenization, and lending.

- Pilot cattle, copper powder, and gold-backed tokenization programs.

- Use existing regulatory licenses as a compliance moat.

At this stage, the goal is simple: prove real-world utility and establish trust.

Phase 2: Scaling to $5 Billion

Once the rails are built, the flywheel begins. The African diaspora sends over $100 billion annually in remittances. Even capturing a fraction of that flow can fuel Ndeipi’s growth.

At the same time, smart-contract village banking and DAOs can anchor circular economies. Micro-apps — from food delivery to insurance — will make the Ndeipi App indispensable. Partnerships with churches, universities, and sovereign institutions will deepen legitimacy.

Phase 3: Toward $50 Billion

At scale, Ndeipi transforms from a fintech product into infrastructure.

- The Afro Gold Dollar becomes Africa’s Tether — a stablecoin trusted in markets plagued by volatility.

- Tokenized cattle, copper, solar, and real estate can be traded globally through a Real World Asset Exchange.

- AI-driven hedging, credit scoring, and anti-corruption systems position Ndeipi as an institutional-grade platform.

- Expansion beyond Africa — into Latin America and Asia — broadens the base.

By this point, Ndeipi is not just a startup. It’s a system.

Phase 4: $500 Billion Market Cap

This is the inflection. Ndeipi achieves critical mass when its 21 million coin cap begins to echo Bitcoin’s scarcity playbook.

- Just as Bitcoin’s limit became its defining feature, NdeipiCoin’s supply anchors value as adoption soars.

- The ecosystem powers everything from village banking to smart cities, creating a digital economic backbone.

- Ndeipi’s valuation rivals global giants because it’s no longer an African project — it’s part of the global order.

At $500 billion, Ndeipi becomes a new pillar of global finance.

Why 21 Million Matters

Bitcoin’s genius wasn’t just cryptography — it was narrative. Scarcity plus adoption became destiny.

For Ndeipi, the 21 million token supply is its Bitcoin moment:

- A once-in-a-generation chance to redefine how Africa plugs into global capital markets.

- A bridge between untapped real wealth (cattle, copper, gold, solar) and liquid, programmable assets.

- A signal to the world: Africa is not just catching up. It is leading.

Conclusion

The path from $50 million to $500 billion may sound audacious, but so did Bitcoin in 2009. Scarcity, trust, and adoption turned an experiment into a revolution.

For Africa, Ndeipi’s 21 million moment could be the same spark — not just creating wealth, but rewriting who controls the future of money.

Leave a Reply