Executive Summary

We are building a blockchain-based asset-backed token that combines the resilience of gold, the liquidity of U.S. Treasuries, and the growth potential of crypto markets. Inspired by Tether’s $172B market cap and 2.8x valuation multiple, our project positions itself to become the “Tether of Africa and the Diaspora.” Unlike Tether, governance rests with token holders, who ultimately decide where funds are invested.

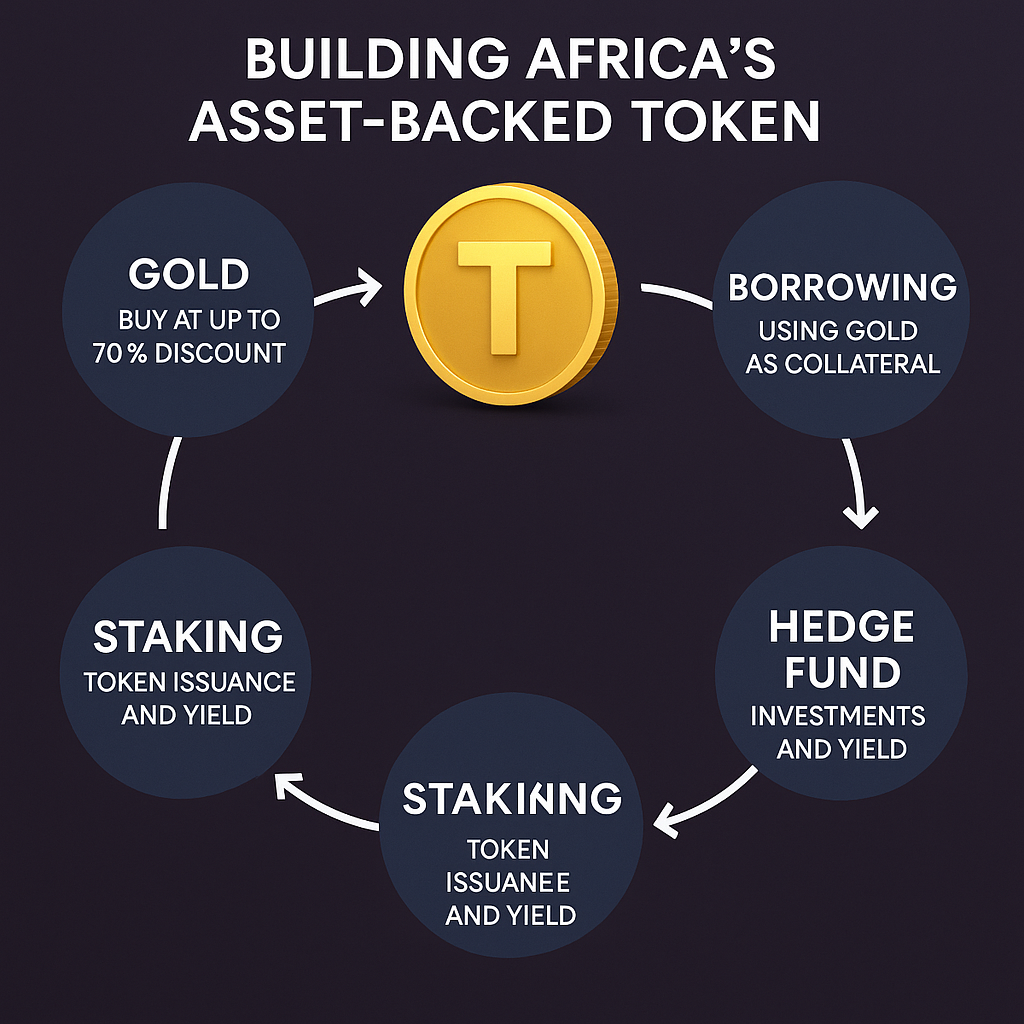

Our model leverages unique opportunities—buying gold at up to a 70% discount, investing in mines in the U.S. and Zimbabwe, and capturing idle liquidity (over $5B) floating outside traditional banking systems in Africa. By staking, borrowing, and building, we create a flywheel that can rapidly scale to a $5B token valuation and beyond.

Problem Statement

Billions of dollars across Africa remain outside the formal banking system, eroding in value due to inflation, lack of trust, and limited access to investment products. Meanwhile, crypto adoption is accelerating, but most stablecoins and asset-backed tokens are controlled offshore with little African participation in governance or value creation.

There is a need for:

- A trusted, asset-backed token tied to real-world assets.

- Community-driven governance where holders control investment decisions.

- A mechanism to unlock trapped liquidity and create yield opportunities locally and globally.

Market Opportunity

- Stablecoins: Tether’s $172B market cap validates demand for asset-backed tokens.

- Gold: Prices have surged, with African gold production providing both supply and discounted acquisition opportunities.

- Unbanked capital: Zimbabwe alone holds $5B outside the banking system. Scaling across Africa could unlock multiples of this.

- DeFi integration: Users globally are seeking yield-bearing, collateral-backed tokens.

Solution

We are creating a multi-asset backed token governed by its holders.

Key Features:

- Asset Backing: Gold (discounted acquisitions via Orex), Bitcoin, U.S. Treasuries, and select high-yield investments.

- Governance: Token holders vote on investment decisions—ensuring transparency and community participation.

- Staking & Borrowing: Users stake tokens for yield. Borrowing against gold provides liquidity while maintaining asset backing.

- Treasury Allocation: A managed hedge fund invests surplus reserves into vetted opportunities (gold mines, infrastructure, DeFi yield).

- Ecosystem Partnerships: 10+ crypto companies already lined up to build on the token rails.

Business Model

Revenue Streams:

- Transaction fees on staking and borrowing.

- Yield from Treasury investments (gold, Bitcoin, U.S. Treasuries).

- Equity participation in strategic projects (mines, real estate, infrastructure).

- Platform fees from companies building on the token rails.

Tokenomics:

- Initial circulation backed by gold at 70% discount.

- Flywheel effect: more staking → stronger backing → higher demand → token price appreciation.

- Treasury continuously reinvested to compound value.

Competitive Advantage

- Discounted Gold Access: Buying gold at 70% below market price provides a margin advantage no competitor can match.

- Community Governance: Unlike Tether or USDC, holders directly decide investment allocations.

- African Liquidity Capture: First-mover advantage in formalizing billions of dollars of idle capital in Zimbabwe and beyond.

- Advisor Network: Cayman structuring, Solana-inspired playbook, and Founder Institute network ensure world-class execution.

Go-to-Market Strategy

- Phase 1: Gold Anchoring

- Secure discounted gold through Orex platform.

- Launch staking mechanism for token issuance.

- Begin borrowing/lending features.

- Phase 2: Hedge Fund Deployment

- Token holders vote on Treasury allocations.

- Invest in U.S. and Zimbabwean gold mines.

- Engage African diaspora capital pools.

- Phase 3: Ecosystem Expansion

- Onboard crypto companies to build apps/services on the token.

- Integrate with remittances and cross-border payment systems.

- Scale token into African and global DeFi markets.

Financial Projections

- Year 1: $5B token valuation (anchored by gold + Zimbabwe liquidity).

- Year 3: $50B token valuation (regional scale, hedge fund returns compounding).

- Year 5: $500B token valuation (Africa’s Tether, rivaling global stablecoins).

Revenue scales proportionally with token circulation, staking activity, and Treasury investments.

Governance & Team

- Token Holders: Ultimate decision-makers on investments.

- Hedge Fund Team: Manages Treasury allocations and yield strategies.

- Advisors: Structuring expertise in Cayman; global crypto/fintech partners.

- Leadership: Founder-led with decades of experience across fintech, DeFi, and African markets.

Risks & Mitigation

- Commodity Volatility: Diversify across gold, Bitcoin, and Treasuries.

- Regulatory Shifts: Structure in crypto-friendly jurisdictions (Cayman).

- Adoption Risk: Partner with 10+ crypto companies from launch to bootstrap usage.

Conclusion

The hay is ready. The sun is shining. With gold-backed trust, community-driven governance, and African liquidity as our engine, we are positioned to create the next $500B token economy. This isn’t just about matching Tether—it’s about building something more transparent, more inclusive, and more grounded in real assets.

Leave a Reply