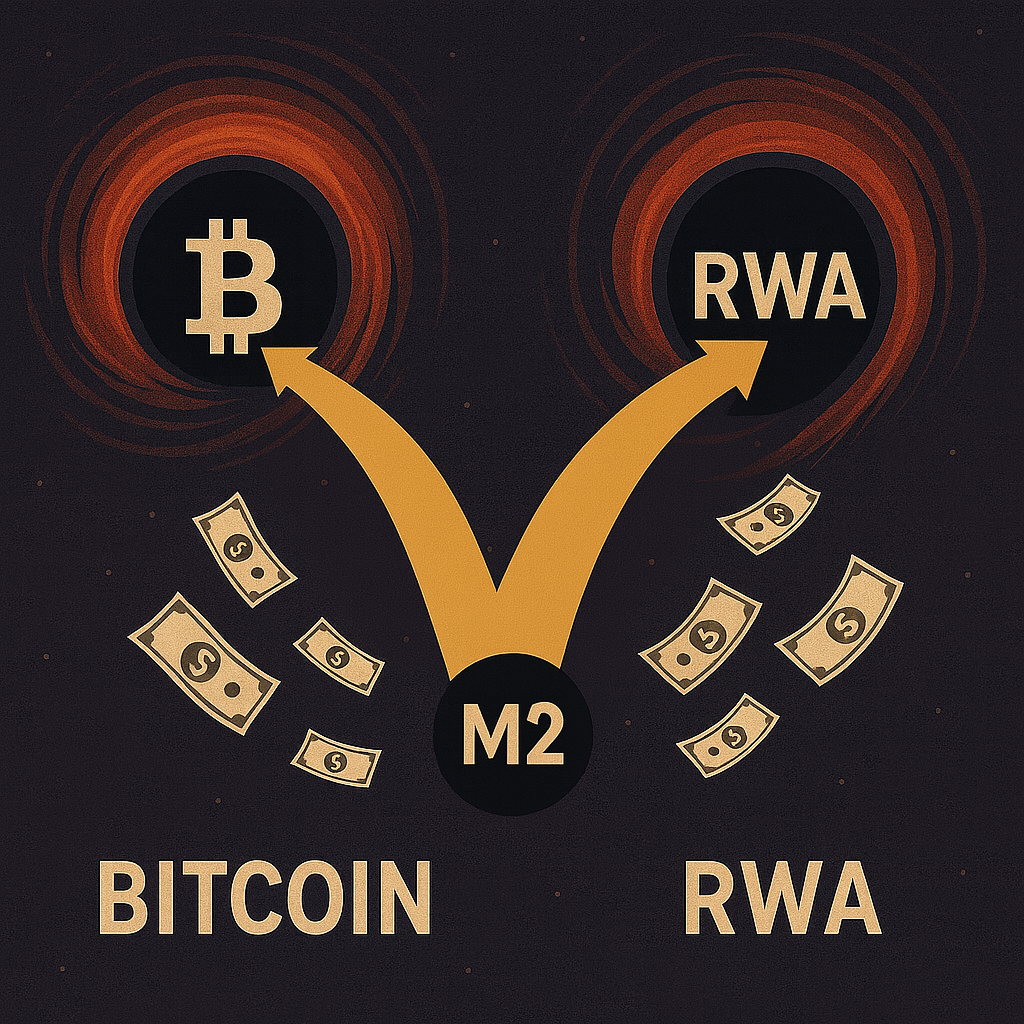

Bitcoin won’t hit $1 Billion due to RWAs taking the excess liquidity from M2

For years, Bitcoin Maxis have promised the moon: “$10 million per coin. $1 billion per coin. Number go up forever.”

But the real world is about to intrude on that fantasy — in the form of $200 trillion worth of real-world assets (RWAs) moving on-chain, backed not by shaky fiat, but by gold-backed tokens.

And when that happens, Bitcoin won’t skyrocket to infinity. It will stabilize — somewhere around $1 million per coin.

That’s not the end of Bitcoin. That’s its graduation.

Why Infinite Bitcoin Is a Mirage

The “all liquidity goes into Bitcoin” thesis only works as long as Bitcoin is the only scarce, non-sovereign digital asset.

But RWAs backed by gold tokens rewrite the rules:

- Tokenized treasuries and bonds absorb yield-seeking capital.

- Tokenized real estate and commodities absorb inflation hedgers.

- Tokenized gold provides the ancient trust anchor central banks already understand.

Suddenly, Bitcoin isn’t the lone lifeboat. It’s part of a fleet.

Where Bitcoin Actually Lands

Let’s do the economics.

- Global wealth ≈ $500 trillion.

- Bitcoin supply = 21 million coins.

- If Bitcoin captures 2–10% of global tokenized wealth, that’s $475k–$2.4M per coin.

The most likely scenario? Somewhere in the middle: around $1 million per BTC.

That’s not collapse. That’s monetary stabilization. Bitcoin stops being a speculative rocket ship and becomes what gold once was: the base collateral of the world economy.

The Zimbabwe Lens

I grew up in Zimbabwe during hyperinflation. At the peak, everyone ran into the U.S. dollar. Prices exploded, and USD looked like salvation.

But once the reset came, liquidity spread out again — into land, cattle, and real assets. USD didn’t “go to infinity.” It stabilized as the unit of account.

Bitcoin will play the same role in a tokenized world. The flood of liquidity goes into BTC during fiat panic. But when $200T of RWAs are tokenized and backed by gold, capital disperses. Bitcoin stabilizes.

Why Stabilization Is Good

Hyper-volatility makes Bitcoin a speculative toy. Stabilization makes it money.

- A $1M Bitcoin is still a trillion-dollar reserve asset.

- It’s still censorship-resistant, trustless, and global.

- But it no longer needs “infinity” to win. It needs stability.

That’s the checkmate Maxi narratives don’t want to admit: Bitcoin’s destiny isn’t endless appreciation. It’s becoming the monetary constant of a multi-trillion-dollar tokenized economy.

⚡ Final Thought:

If you’re betting on Bitcoin to “go to infinity,” you’re missing the point.

The real victory is when Bitcoin stops mooning… and starts anchoring.

Because that’s when it stops being speculation — and becomes civilization’s money.

Leave a Reply