By Dr. Tyrone Moodley

Zimbabwe’s monetary history reads like a tragic novel of repetition — each chapter more desperate than the last. From the death of the Zimbabwe dollar in 2009 to the birth of the bond note, and now the Zig, citizens have endured wave after wave of currency experiments, each promising stability and delivering erosion. The attached analysis from the Chair of the Institute for Monetary and Financial Research lays bare the central problem: there has never been a credible system that secures public trust, safeguards deposits, and resists manipulation by either market or political forces.

Enter the Ndeipi Decentralized Wallet — not a speculative token play, but a structural solution to this recurring tragedy.

1. Trust: The Missing Currency

The report correctly points out that “currencies are always in competition with each other” and that credibility — not decree — determines survival. Zimbabweans have lived through six hyperinflationary episodes precisely because belief in the local unit was continuously violated. You cannot legislate confidence; it must be earned.

The Ndeipi Decentralized Wallet is built to restore this trust from the ground up. Instead of a central authority determining value, Ndeipi anchors each token to real, verifiable assets — gold, copper, cattle, and energy — all tokenized and stored transparently on the blockchain. Every transaction, collateral, and reserve is viewable on-chain. That transparency is the first step toward credibility.

Where the Central Bank has historically failed to inspire belief, a decentralized system distributes belief across thousands of nodes — ordinary citizens, diaspora investors, and institutional partners — who can verify rather than merely hope.

2. From “Cash Cow” to “Stakeholder”

The report describes Zimbabwean depositors as “cash cows” — consumers of banking fees rather than beneficiaries of banking equity. The phrase “the fee bringer of last resort” captures the cruelty of a system that punishes savers for their trust.

Ndeipi’s model flips this dynamic. Wallet users become equity participants, not passive depositors. Each user can stake assets in the Afro Gold Dollar Stablecoin, backed by gold and Bitcoin, or participate in real-world asset (RWA) projects such as solar farms, copper powder plants, or tokenized cattle ventures. In doing so, the line between depositor and investor disappears — the citizen becomes the shareholder.

This is what the banks and regulators have never offered: an economy where ordinary people are capital providers, not victims of monetary collapse.

3. A Decentralized Monetary Policy

By 2030, the Central Bank aims to phase out the USD and enforce the Zig as the sole currency. Yet as the Institute’s Chair warns, “the chances of another meltdown are very high.” The Ndeipi ecosystem provides a hedge against exactly that.

Through its AI Hedging Agent, the Ndeipi Wallet automatically allocates value between Bitcoin, gold, and Afro Gold Dollar — a mechanism inspired by Ray Dalio’s risk-parity model. Instead of a static peg vulnerable to local shocks, users hold dynamic digital reserves that adjust to global market realities.

In this sense, the Ndeipi Wallet represents not a rebellion against monetary policy, but an upgrade to it — one that replaces bureaucratic discretion with algorithmic transparency.

4. From Hyperinflation to Hyper-Inclusion

Zimbabwe’s banks have long profited from exclusion — extracting fees from those who could least afford them while shutting out the unbanked. The Ndeipi Wallet, by contrast, functions as a universal financial passport. Anyone with a mobile phone can save, borrow, or invest — without permission from a bank, without currency conversion barriers, and without arbitrary limits on access to capital.

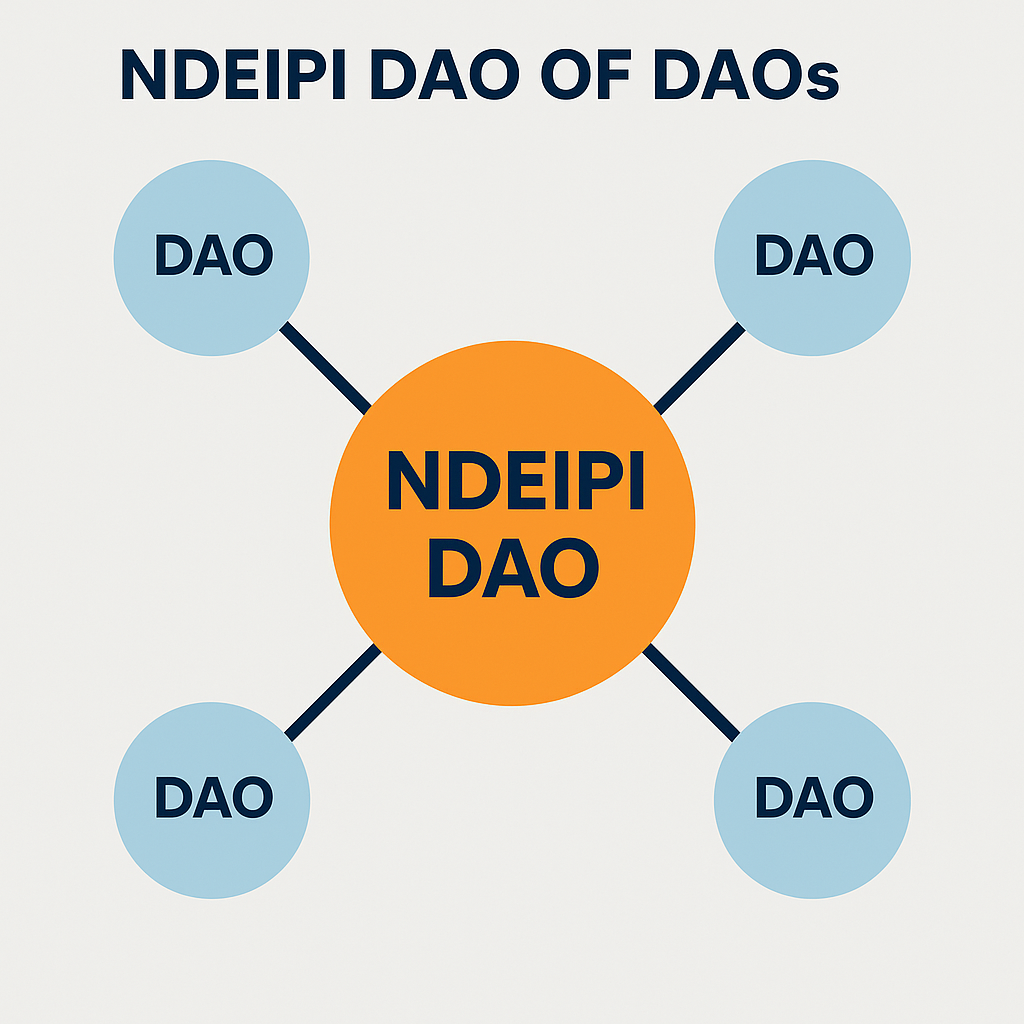

In rural areas, Chiefs can use Ndeipi’s DAO-based governance system to tokenize cattle, fund dams, and provide microloans through smart contracts. In cities, professionals can stake tokens, earn yield, or participate in collective investment schemes backed by tangible commodities. This is what financial inclusion looks like when built on transparency rather than paternalism.

5. Rebuilding Confidence from the Ground Up

To paraphrase the Institute’s conclusion: “I have failed to detect any concrete steps or measures designed to secure the confidence of the general public in the Zig.”

The Ndeipi Wallet is that concrete step. It is not an abstract reform but a practical framework that merges the old and the new: gold as trust, blockchain as verification, and community ownership as accountability.

The question isn’t whether Zimbabwe can afford to decentralize — it’s whether it can afford not to. Because credibility once lost is almost impossible to recover through decree. But through transparent, asset-backed systems like Ndeipi, it can be rebuilt — one verified transaction at a time.

Conclusion

Zimbabwe’s economic story need not be one of endless rebirth and decay. The Zig, like its predecessors, may yet fail if it repeats the mistakes of centralized trust and opaque policy. But there is a parallel path — a decentralized alternative that empowers rather than exploits.

The Ndeipi Wallet isn’t just a fintech product. It is a statement: that African money can be trusted, that ownership can be shared, and that belief — the most valuable currency of all — can finally be earned back.

Leave a Reply