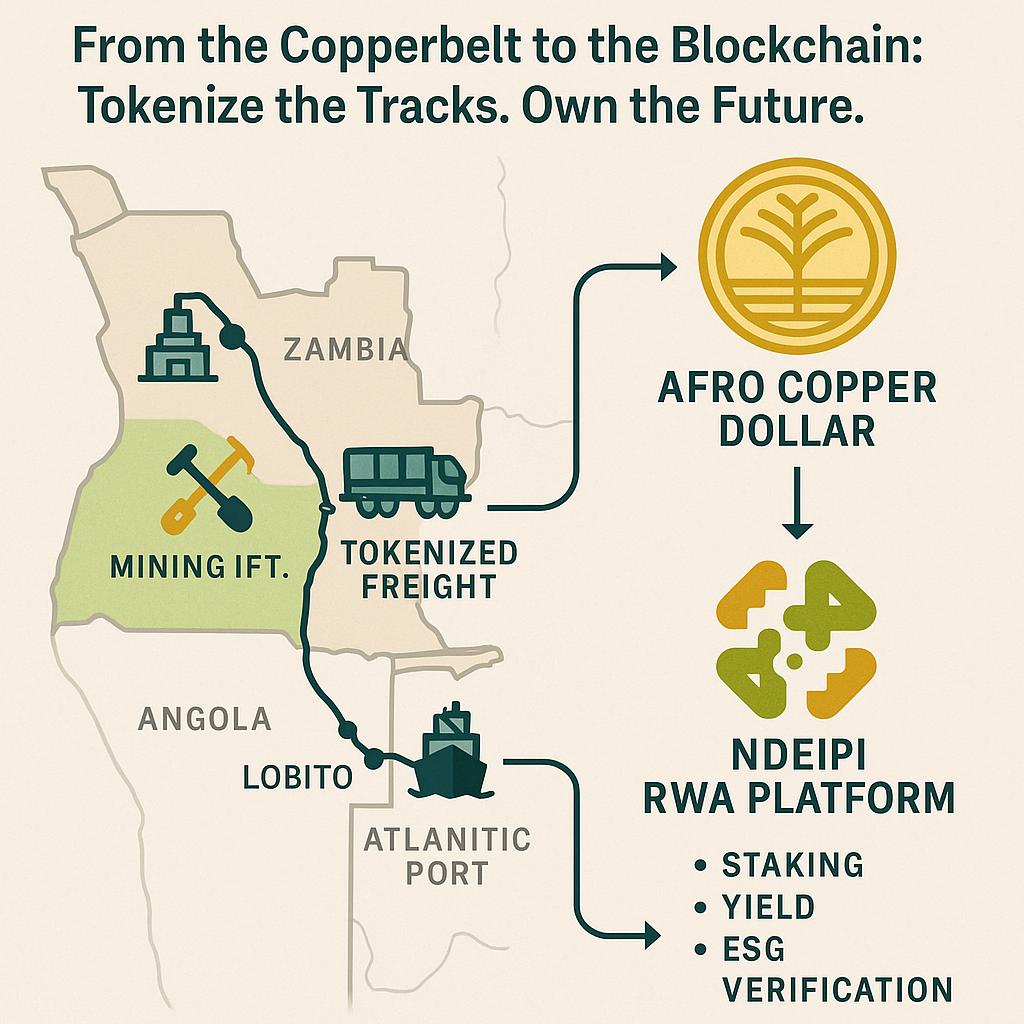

Africa’s most ambitious rail project—the Lobito Corridor—represents more than just steel and sleepers stretching across Angola and Zambia. It’s the physical backbone of a new digital economy. By linking Zambia’s copper mines to Angola’s Atlantic ports, the Africa Finance Corporation (AFC) is cutting the journey of copper to global markets from 45 days to just 7. But beneath the headline lies a deeper opportunity: tokenizing this trillion-dollar logistics corridor.

From Steel Tracks to Smart Contracts

The Lobito Corridor can become the first railway in the world where every kilometer, every ton of copper, and every carbon credit is recorded and traded on-chain. Through tokenization, ownership and financing of the railway’s development could shift from a few institutional backers to a global marketplace of micro-investors. Each stake, represented as an NFT or fractional token, would represent real-world infrastructure—backed by copper flow, carbon offsets, and transport fees.

Imagine a LobitoRail Token (LRT) backed by:

- The physical railway asset (verified by AFC and regional governments)

- Revenue from copper transport and trade fees

- Carbon credit offsets from shifting cargo off diesel trucks

- Yield-sharing mechanisms tied to mining throughput

Each token holder wouldn’t just speculate—they’d co-own a piece of Africa’s logistics revolution.

Financing the Future: How Tokenization Democratizes Infrastructure

Traditional project finance relies on a pyramid of debt, equity, and public guarantees. It’s slow, opaque, and heavily dependent on foreign lenders. Tokenization flips this. Using a blockchain platform—say, Polygon or Stellar—the AFC could issue digital securities representing future cash flows from the railway.

A simple model:

- $1 billion total project value

- $250 million raised via tokenized bonds at 5–7% yield

- Tokens trade on a regulated RWA (Real World Asset) marketplace

- Retail investors in Africa, the diaspora, and ESG funds can participate directly

For the first time, a teacher in Lusaka or a copper trader in Toronto could invest in the same railway as institutional funds in Lagos or Milan.

The Copper Corridor DAO

A Corridor DAO could govern this system—bringing together mining companies, engineers, financiers, and citizens. Governance tokens would vote on sustainability metrics, infrastructure upgrades, and reinvestment strategies. Smart contracts would automatically route profits into community development, education, or new feeder lines connecting local mines.

This isn’t fantasy. It’s the natural evolution of public-private partnerships in the blockchain era: decentralized infrastructure finance (DeInfra).

Strategic Edge: Hedging Copper with Crypto

Zambia’s copper is the lifeblood of the energy transition. As EVs, batteries, and solar farms multiply, demand for copper will only rise. By connecting copper supply to a digital token ecosystem, Zambia could create a copper-backed stablecoin—the Afro Copper Dollar—that tracks real production rather than speculative fiat. The Lobito Corridor would then serve as both the logistical and data oracle validating the currency’s backing in real time.

Tokenized freight, tokenized copper, tokenized returns. One corridor, infinite digital rails.

Why It Matters

Infrastructure has always been about nation-building. But tokenized infrastructure is about civilization-building. It invites the world to invest not through extraction, but participation. It turns African copper into a digital commodity that powers both microchips and micro-economies.

The Lobito Corridor could thus become more than a railway—it could become Africa’s first tokenized trade artery, connecting minerals, money, and metadata from mine to market.

Tagline:

From the Copperbelt to the Blockchain: Tokenize the Tracks. Own the Future.

Leave a Reply