There are moments in history when a single invention flips the script so hard that the world needs a minute to understand what just happened. Most people completely miss the early signs. They laugh at the Wright brothers. They dismiss Bitcoin. They shrug at mobile money in Kenya. They say Africa must “wait its turn.”

Then something unexpected emerges.

Africa just launched its own Tokenization-as-a-Service platform — and it changes everything.

Not a prototype. Not a pitch deck. Not a hackathon demo.

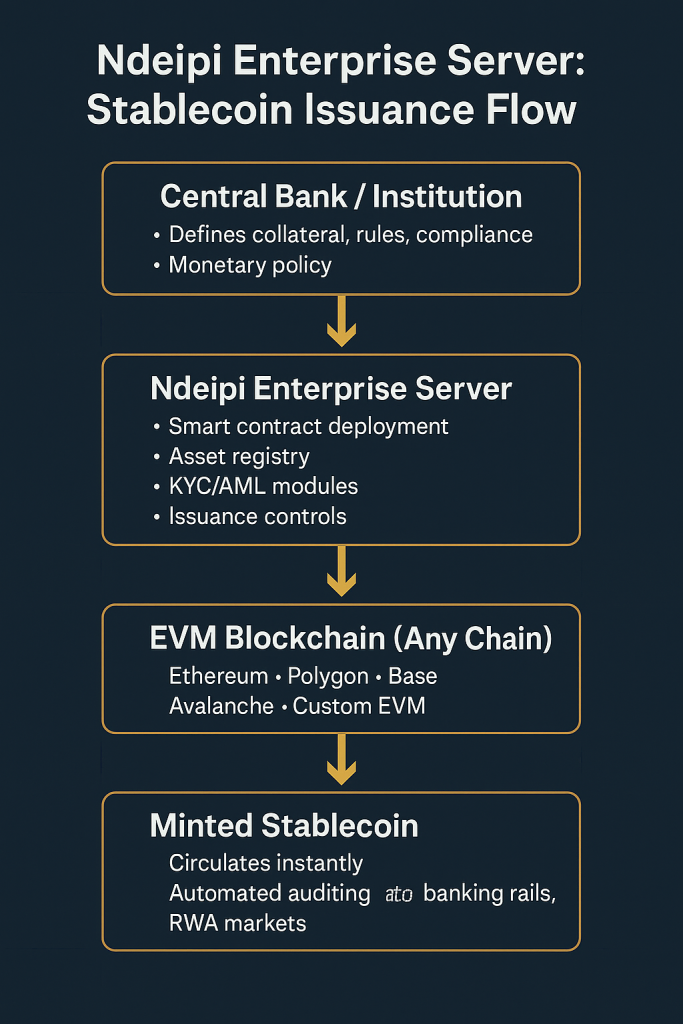

A fully functional enterprise-grade system that allows central banks and financial institutions to issue their own stablecoins on any EVM blockchain.

It’s called Ndeipi Enterprise Server.

And it was built 100 percent by Africans. For us by us.

If that sentence didn’t set off alarm bells in the global fintech world, it should.

The World Thought Africa Would Be a User. Instead, Africa Became a Builder.

For decades, the narrative was painfully predictable: Africa imports technology. Africa consumes technology. Africa follows.

Not this time.

Ndeipi Enterprise Server doesn’t just “join” the tokenization wave — it shatters the assumption that monetary infrastructure must be built in New York, London, or Silicon Valley.

Africa now has its own monetary engine. A programmable, sovereign-grade engine.

One that central banks can use to mint digital currencies.

One that governments can use to build transparent financial rails.

One that institutions can use to tokenize real-world assets and settle value instantly.

One that runs on Ethereum, Polygon, Base, Avalanche, or any EVM chain like it’s nothing.

Stablecoins Are the New Monetary Superpower — And Africa Just Claimed Its Seat

Let’s be honest. Every major power is racing to build its own digital currency. America. China. Europe. The Gulf. BRICS. Whoever controls their digital currency controls their monetary future.

Africa needed its own engine.

Now it has one.

A central bank in Africa can wake up tomorrow and issue a digital currency without flying consultants from five continents or begging for Western software licenses.

A regional bloc can launch a cross-border settlement system in weeks instead of decades.

A government can track funds transparently — ending the excuses and loopholes that have drained wealth for generations.

All off a single African-built platform.

This Isn’t a Fintech Moment. It’s a Geopolitical One.

When Africa starts exporting monetary infrastructure, the power dynamic flips.

Because the global financial system isn’t being disrupted — it’s being rewritten.

Institutions abroad will soon be asking for “the African system” because:

• It’s modular and fast

• It’s designed for real productive assets

• It integrates with any EVM chain

• It’s built for emerging markets, not Wall Street fantasies

This is how continents rise.

Not by copying. By building original infrastructure the world eventually needs.

The Future of Global Finance Might Have an African Accent

A decade from now, students in fintech courses will study how Africa’s first indigenous tokenization server ignited a quiet revolution. Countries will look back and wonder how they missed the early signs.

Ndeipi Enterprise Server is more than a platform.

It’s a signal.

Africa isn’t knocking on the door of global finance. Africa is building the door. Africa is installing the hinges. Africa is writing the access protocol.

And the world will have no choice but to walk through it.

The next chapter isn’t coming.

The next chapter just launched.

Leave a Reply