Hydrate 💦 Earn DropletCoin 💧

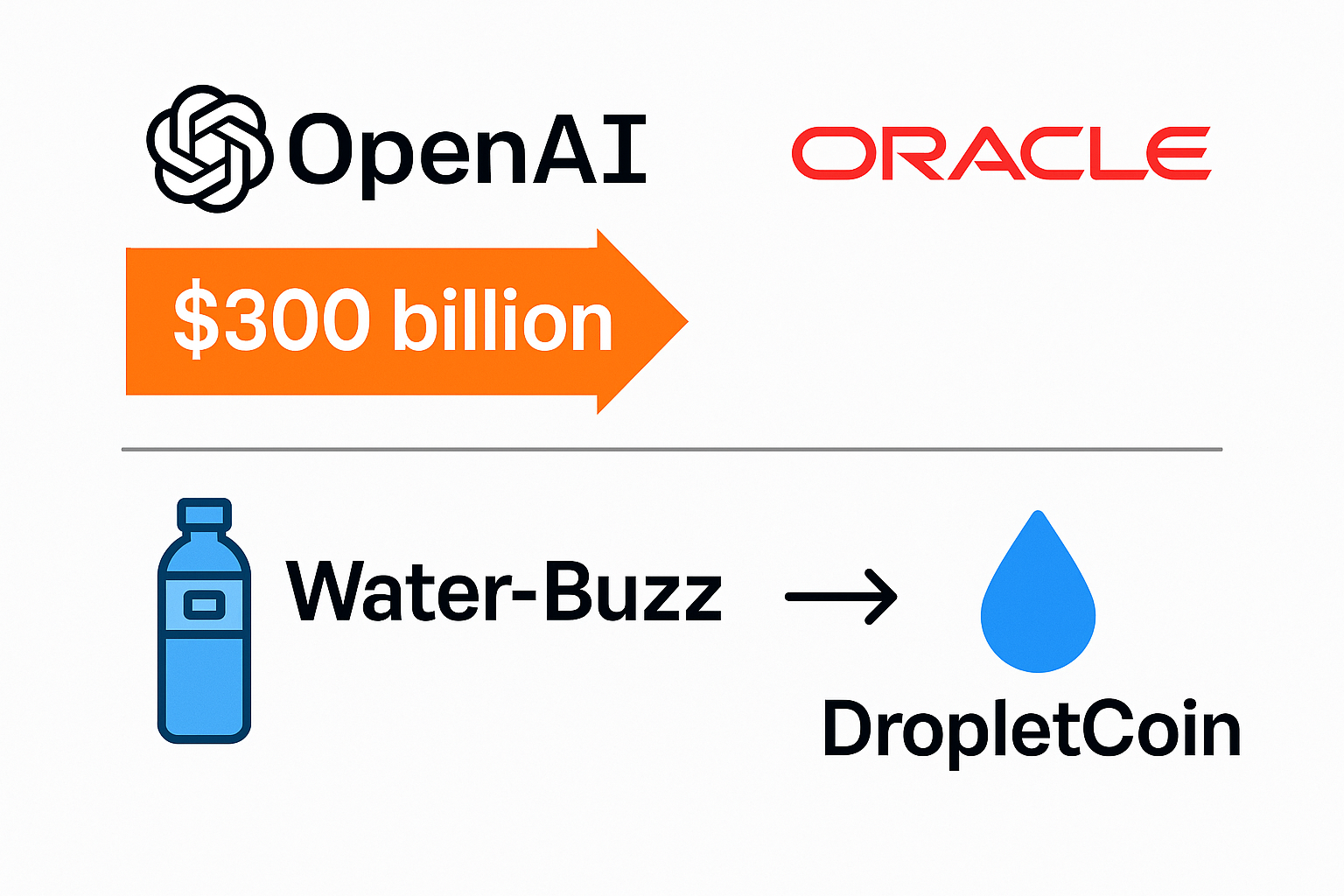

The headlines say it all: OpenAI has signed a $300 billion contract with Oracle to secure 4.5 gigawatts of compute power — enough to light up four million homes. Oracle stock surged 43%, Larry Ellison instantly became the world’s richest man, and Wall Street nodded in approval.

But beneath the headlines is a clear signal for investors: the AI economy is an infrastructure play. The real profits will flow not just from software, but from the trillions invested into power, chips, and data centers.

That’s where DropletCoin 💧 comes in — a consumer-driven, asset-backed way to democratize access to the very same megatrend.

Why Hydration?

The human brain needs hydration to perform. Likewise, artificial intelligence needs energy and compute to grow. DropletCoin connects these two worlds.

Every time a consumer hydrates through a WaterBuzz smart bottle or wearable, they earn DropletCoins. Behind the scenes, those tokens are tied to infrastructure projects — solar farms, AI compute clusters, and grid-stabilizing assets.

It’s not just gamification of wellness. It’s tokenized participation in the largest industrial build-out of our time.

How DropletCoin Works as an Investment Vehicle

- Tokenomics linked to real assets: DropletCoin supply is backed by investment into solar power and AI compute, assets that mirror the demand curve created by OpenAI, xAI, and others.

- Everyday adoption as a growth flywheel: Consumer hydration becomes the on-ramp to infrastructure investment, expanding participation far beyond accredited or institutional investors.

- Yield potential: DropletCoin can be staked, swapped, or used in DeFi pools, with yield streams connected to underlying infrastructure projects.

- Scalability: Each sip scales into more DropletCoins, more capital pools, and more deployed hardware — tying micro-behavior to macro-infrastructure.

The Macro Case

- AI Compute Demand: If OpenAI alone needs 4.5 GW by 2027, the total AI sector will require multiples of that, creating sustained demand for clean energy and chips.

- Grid Pressure: Traditional energy markets cannot keep up, making solar + AI colocation one of the most attractive long-horizon investment themes.

- Retail On-Ramp: DropletCoin creates a “Robinhood for AI infrastructure” — where consumers can participate in the same growth story as institutional investors.

Why Investors Should Pay Attention

Oracle’s $300 billion bet is the railroad build-out moment of the 21st century. DropletCoin is positioned as the retail gateway to that same theme — linking consumer adoption to institutional infrastructure growth.

Investors who understand that AI = energy + compute will recognize the value of a token that ties everyday behavior (hydration) to capital pools funding this industrial revolution.

Closing Thought

The AI gold rush won’t be won by apps alone — it will be won by those who own the shovels, the power lines, and the servers. DropletCoin 💧 turns that reality into a consumer movement and an investor opportunity.

In other words: every sip is a stake in the Gigawatt AI Era.

Leave a Reply