How Ndeipi is helping Tokenize Real World Assets.

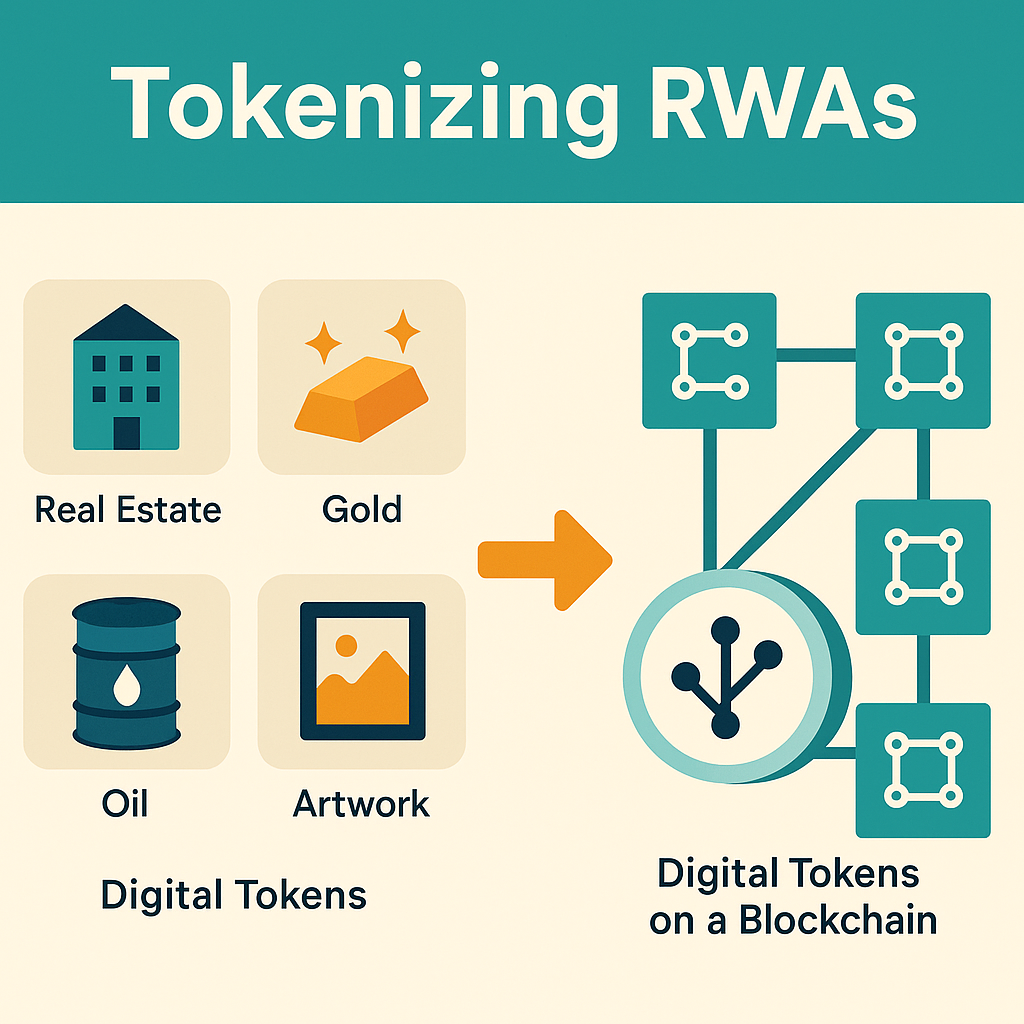

The phrase “tokenization of real world assets” sounds futuristic, but it’s quickly becoming one of the biggest financial shifts of our time. At its core, tokenization means taking something tangible—like real estate, gold, or even music royalties—and representing ownership of it as a digital token on a blockchain.

Tokenizing Projects Explained

Tokenizing projects are efforts to take something that exists in the “real world” (a building, a farm, a barrel of oil, a piece of art, even future revenue streams) and represent ownership or rights to it in the form of digital tokens on a blockchain. Each token is like a tradable certificate of ownership, entitlement, or participation.

Here’s the core idea:

Instead of treating assets as chunky, illiquid things that only big institutions can trade, you slice them into smaller, digital pieces and make those pieces easy to buy, sell, and transfer.

A Few Flavors of Tokenization

- Real estate tokenization: A $10 million building could be represented by 10 million tokens. Each token equals $1 worth of ownership. Suddenly, regular investors can own a piece of Manhattan without buying the whole skyscraper.

- Commodity tokenization: Gold, copper, lithium, even cattle can be tokenized. The token is either backed by the physical asset in a vault/warehouse or tied to production rights.

- Equity and debt tokenization: Company shares, startup stock, or bonds issued as tokens. They trade faster and can even include programmable rights (like automatic dividends).

- Utility token projects: Tokens represent access, membership, or usage rights—like prepaid digital credits.

- Cultural tokenization: Artworks, music royalties, or even memes can be split into tokens so fans and investors share in the upside.

Why People Do It

- Liquidity: Assets that normally take months to sell (land, private equity) can be traded instantly.

- Fractional ownership: Lowers the barrier to entry—more people can participate.

- Transparency: Blockchain records every transfer, reducing disputes.

- Programmability: Tokens can carry smart contract rules (e.g., automatic revenue sharing).

- Global reach: Anyone with internet access can participate, not just local investors.

Challenges & Regulatory Landscape

Tokenizing projects sit at the crossroads of finance, law, and technology. They’re both exciting and messy because regulators are still figuring out how to treat them—are they securities, commodities, collectibles, or something new?

That’s why some projects succeed wildly (tokenized U.S. Treasuries on-chain are booming), while others hit legal quicksand. The framework for tokenized ownership is still evolving, and different jurisdictions are experimenting with different rules.

The Frontier: When Everything Is Tokenized

The most fascinating question is what happens when everything is tokenized. Capital markets could be rewired from the ground up, and assets would start competing for liquidity with Bitcoin, Ethereum, and other digital currencies.

Imagine a world where you can move seamlessly between tokenized gold, shares in a company, a slice of farmland, and even digital art—all inside the same wallet. That’s not science fiction anymore; it’s the trajectory of financial innovation today.

Live Tokenization Projects: Real Examples

To make all of this more concrete, here are some of the major live projects and funds that are showing what tokenization of real world assets actually looks like in practice.

| Project | What it is / Who’s behind it | Why it matters / Key features |

|---|---|---|

| BlackRock – BUIDL (USD Institutional Digital Liquidity Fund) | A tokenized money market-fund launched in March 2024 by BlackRock, tokenized via Securitize. Backed by short-term U.S. Treasuries, cash, repo agreements. | It passed $1B in assets under management in under a year. It supports near real-time trading and transfers, daily dividend payouts, and is accepted as collateral on major crypto exchanges (e.g., Crypto.com, Deribit). Also, it’s expanding to multiple blockchains beyond just Ethereum (Aptos, Arbitrum, Avalanche, Optimism, Polygon). |

| Franklin Templeton – FOBXX / Benji / OnChain U.S. Government Money Fund | Franklin Templeton’s SEC-registered mutual fund which has been a front-runner in tokenization. Its shares are represented by tokens (one share = one token) and it uses blockchain for recordkeeping & peer-to-peer transfers. | It enables capability like peer-to-peer transfer of the fund shares, which bypasses some traditional intermediaries. The fund has grown substantially: hundreds of millions in assets, showing real demand. Also, it’s pushing utility: converting stablecoins to buy shares, transfers on public blockchain. |

| Others / Emerging Projects | There are several smaller or regionally-focused tokenization projects, e.g.: Realize T-BILLS Fund in Abu Dhabi (digitizing U.S.-Treasury-focused ETFs into tokens), and development of tokenized bond issuances by institutions like Goldman Sachs. | These show how tokenization is extending beyond U.S. money markets into global settings, regulatory regimes outside the U.S., and different asset classes like ETFs and bonds. They also test how cross-border, blockchain-native and TradFi-compliant systems work together. |

How These Examples Illustrate the Key Benefits & Trade-Offs

These real projects highlight a few of the promises and challenges of tokenization:

- Liquidity and utility: BUIDL being used as collateral, peer-to-peer transfers in BOFXX—these show that tokenization isn’t just wrapping old assets in a new shell but enabling new functions.

- Regulation matters: These are generally projects by large, regulated firms; they move slower, must comply with securities laws, AML/KYC rules, etc. That adds friction.

- Interoperability & blockchain choice: Many projects are multi-chain. Choosing the chain(s) impacts speed, cost, custody, integration with DeFi.

- Access: Some of these are for institutional or qualified investors (e.g. high minimum investments), which means tokenization isn’t fully democratised yet.

Final Thoughts

These active tokenizing projects show that the tokenization of real world assets is no longer a futuristic ideal—it’s happening now.

They offer live proof that fractional ownership, faster settlement, global reach, and programmable finance are not just hype, but real changes. Still, the legal, technical, and operational plumbing needs more polishing before everyone can access these benefits.

Leave a Reply