Why Africa is the next frontier.

Building Africa’s Future with African Capital

The Problem We’re Solving

Africa is rich in resources but poor in liquidity. Our minerals, our cattle, our sunlight, our land—all of it too often leaves the continent in raw form, creating wealth for others while our people remain trapped in cycles of debt and dependency.

Foreign investment flows in, but on terms that extract value instead of building lasting capital markets. The result? Africa’s wealth funds the rest of the world, while our own exchanges remain underdeveloped, undercapitalized, and underutilized.

The Ndeipi Solution

We are designing a system that flips this script. The foundation rests on three moves:

- Float Local SPVs

We will create and list Special Purpose Vehicles (SPVs) on the Zambian Exchange and other African exchanges. Each SPV will hold tokenized real-world assets: solar farms, copper powder, cattle, housing projects, or even grain warehouse receipts. Listing locally means value creation stays visible, accessible, and owned by the people. - Treasury as Anchor Investor

Ndeipi’s treasury will act as a cornerstone investor, buying shares in these SPVs. This injects credibility, stabilizes the listing, and shows the world that we are investing in ourselves. Confidence is contagious—when the treasury moves, the market follows. - Global Bridges via Offshore Structures

Through entities in Bermuda or Cayman, we align with international investors who are accustomed to these jurisdictions. This makes African projects legible to global funds. Offshore is not about escape. It’s about creating a bridge. It brings diaspora investors and global institutions into alignment with African-listed companies.

The Tokenization Layer

Every SPV is not just a paper company—it is tokenized. Shares can be fractionalized, digitized, and traded globally on blockchain rails. Imagine a cattle token from Namwala or a copper powder token from Zambia being as liquid as any equity in London or New York.

- Liquidity for Villages: Farmers in Monze tokenize their cattle and access loans.

- Liquidity for Cities: Smart city projects issue tokens backed by housing, copper, and solar power.

- Liquidity for Diaspora: Africans abroad buy tokens of the future they want to build back home.

Why This Matters Now

The global system is creaking under debt. The U.S. printed trillions. Europe is aging. China is slowing. But Africa? Africa is young, resource-rich, and hungry for innovation. The world needs new growth engines—and capital markets are how we plug Africa into that story.

By marrying local listings, treasury support, and global bridges, we unlock liquidity. By tokenizing assets, we make them portable, divisible, and unstoppable.

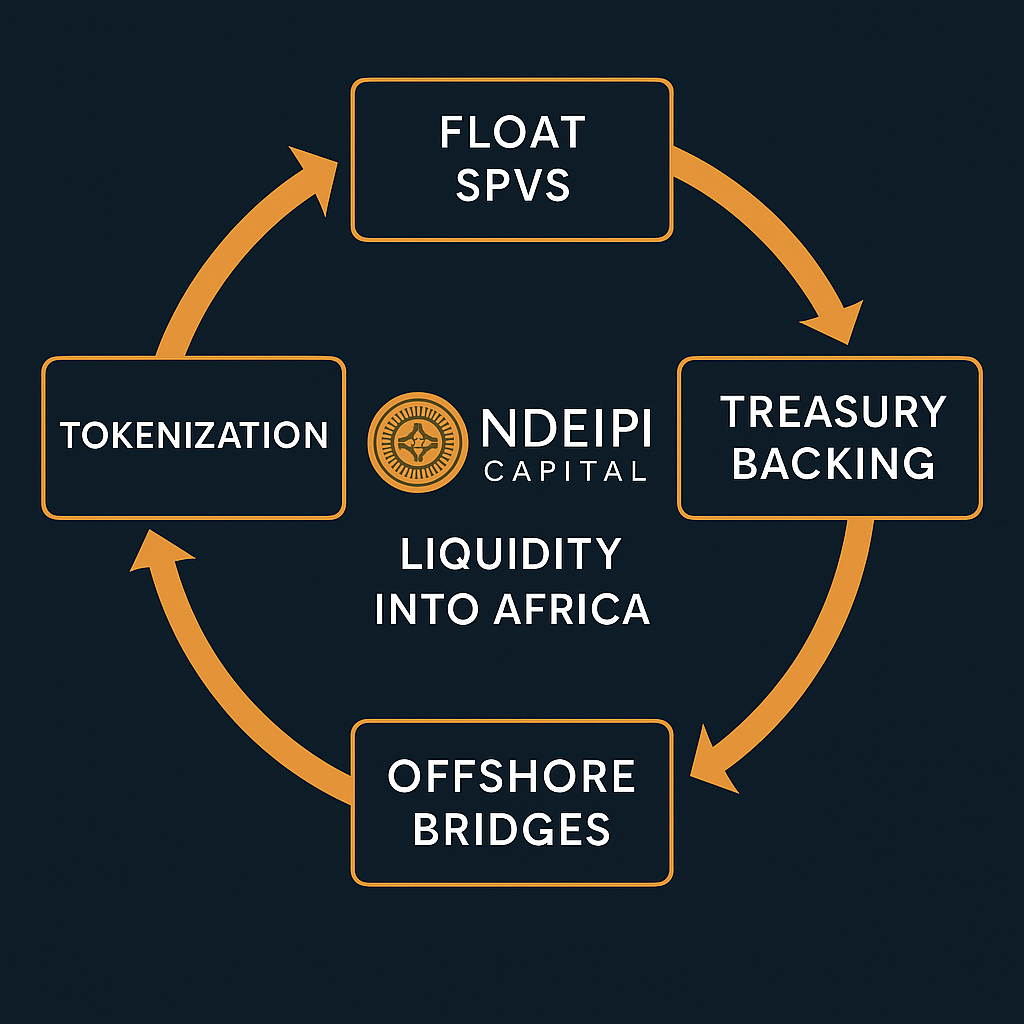

The Flywheel of African Wealth

- SPVs float on African exchanges.

- Treasuries anchor and stabilize them.

- Offshore entities bring global investors.

- Tokenization makes shares global, liquid, and unstoppable.

- Value circulates in Africa rather than leaking out.

This is the flywheel. Once it spins, it compounds.

The Call to Action

The manifesto is simple: Africa must build its own capital markets.

No one else will do it for us.

Ndeipi Capital is not just another fund. It is the architect of an African-owned financial system, rooted in blockchain, powered by tokenization, and committed to keeping wealth on the continent.

We are not waiting for permission. We are floating the future.

Leave a Reply