The world is standing on the brink of a financial transformation. Analysts estimate that more than $200 trillion worth of Real-World Assets (RWAs)—from real estate and commodities to carbon credits and art—could eventually move on-chain. Yet, there’s a catch: tokenizing value isn’t enough. For the RWA revolution to reach its full potential, interoperability and standardization must come first.

At Ndeipi, we’re building the foundation to make that happen.

The Interoperability Problem

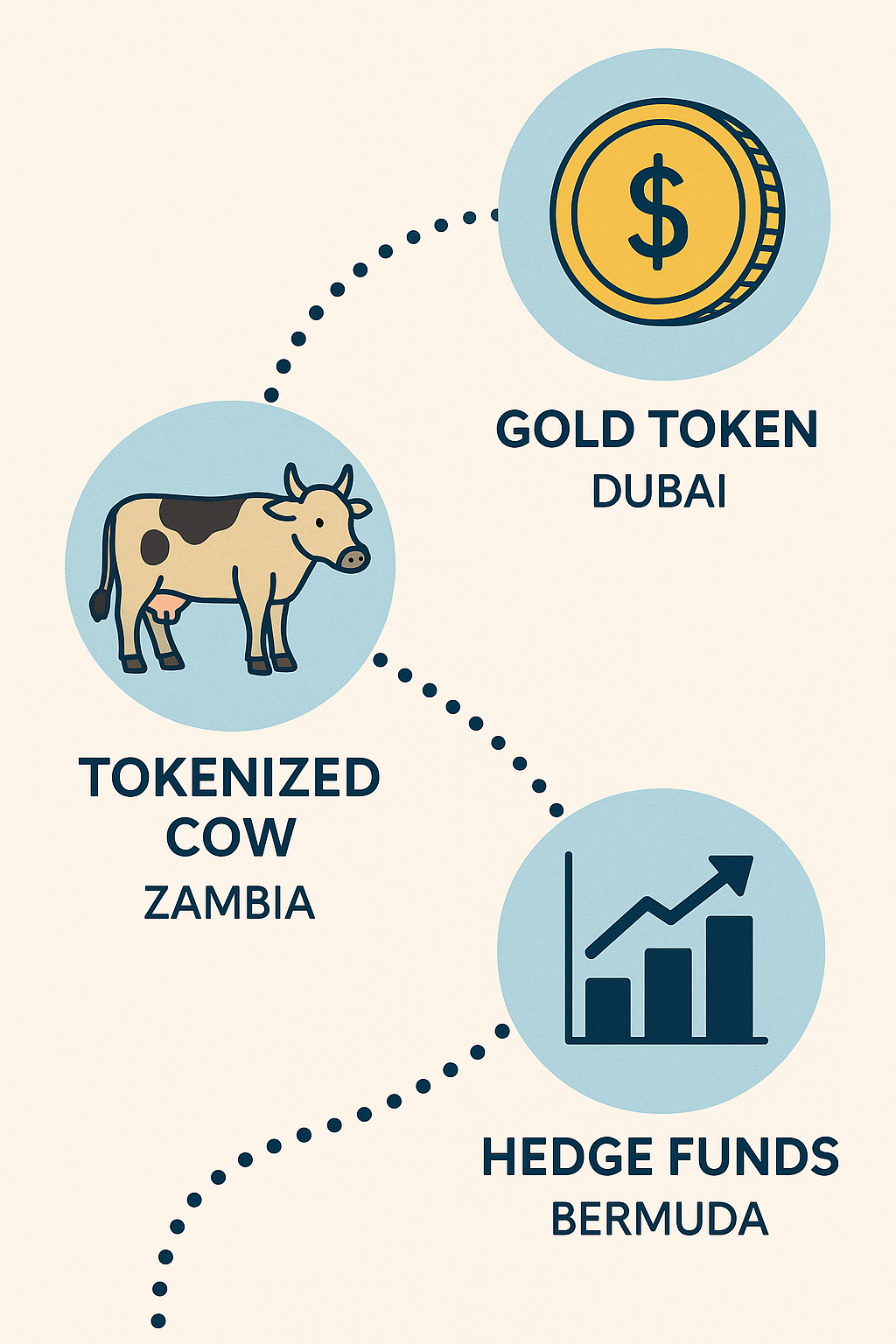

Every jurisdiction has its own definitions, regulations, and formats for how assets are represented. A gold token issued in Dubai doesn’t “speak” the same digital language as a tokenized farm in Zambia or a real estate note in Canada. Without standardized data and compliance protocols, these assets can’t communicate across chains—or across borders.

That fragmentation keeps liquidity trapped in silos. The global market may be tokenizing, but it’s not yet talking to itself.

The Ndeipi Solution: A Platform-as-a-Service for RWAs

Our Ndeipi RWA Platform-as-a-Service (PaaS) was built precisely to solve this. Think of it as a universal plug-in for tokenizing and trading any real-world asset within a single, compliant digital infrastructure.

At its core, Ndeipi operates as a multi-tenant RWA infrastructure layer, powered by Polygon Blockchain and anchored in on-chain compliance. Each asset onboarded—whether gold, cattle, solar energy, or real estate—is wrapped in a standardized data schema and regulatory profile.

This allows Ndeipi to act as a translation layer between worlds:

- A gold-backed token in Zambia can interact seamlessly with a real estate SPV in Canada.

- A tokenized solar farm in Livingstone can trade liquidity with a copper mine in Chile.

- Institutional investors can participate through programmable compliance that respects each jurisdiction’s AML and KYC standards.

Programmable Compliance Meets Global Liquidity

Interoperability isn’t just about cross-chain communication—it’s about trust.

Through on-chain identity modules, smart contract standardization, and compliance-driven metadata, Ndeipi ensures every transaction retains a verifiable trail, regardless of the chain it touches.

Our goal is to build what we call “SWIFT for Tokenized Assets.”

A global settlement layer where liquidity flows freely between blockchain networks—Ethereum, Polygon, Stellar, Quorum, and beyond—without friction, duplication, or loss of transparency.

The Path Forward

Tokenization is inevitable. But for it to truly work, the world’s assets must become interoperable, compliant, and composable—in other words, capable of moving together across digital and legal boundaries.

The Ndeipi RWA PaaS is more than just infrastructure—it’s the plumbing of the next financial system, connecting capital to opportunity in ways that were never possible before.

We’re not just bringing assets on-chain.

We’re connecting economies.

Join us at Ndeipi.com

Building the foundation for a tokenized, interoperable future—one real-world asset at a time.

Leave a Reply