Introduction

Africa isn’t late to the digital revolution — it’s early to the next one. While the West debates crypto regulation and meme coins, a quieter transformation is happening across the continent: the tokenization of real-world assets (RWAs).

Gold mines. Copper fields. Solar farms. Farmland. Even cattle.

All turning into digital tokens — verifiable, tradable, and accessible globally.

This isn’t about speculation. It’s about ownership.

What Is Tokenization of Real-World Assets?

Tokenization takes a physical asset — like a farm in Zambia or a solar plant in Kenya — and converts it into a digital token recorded on a blockchain. Each token represents a piece of that asset, giving investors the ability to buy, trade, or stake it without ever leaving their phones.

It’s fractional ownership meets borderless liquidity.

It’s the bridge between dusty ledgers and decentralized finance.

Why Africa Is the Perfect Testbed

Africa’s biggest challenge has never been resources — it’s been access.

Billions of dollars in gold, copper, land, and energy lie untapped or under-financed because traditional institutions don’t reach far enough.

But blockchain doesn’t need permission or paperwork. It needs code.

With smart contracts replacing middlemen, blockchain becomes the new institution — transparent, incorruptible, and globally connected.

From Lusaka to Lagos, from Harare to Nairobi, tokenization is creating a new generation of digital property owners who no longer need Wall Street to validate their value.

The $10 Trillion Opportunity

According to global estimates, tokenized RWAs could hit $10 trillion by 2030. But here’s the hidden truth: Africa holds the majority of the world’s critical minerals, agricultural land, and renewable energy potential.

Whoever builds Africa’s tokenized infrastructure today will hold the keys to tomorrow’s global wealth engine.

That’s why platforms like Ndeipi are leading the charge — allowing users to mint tokens backed by real assets, not just hype.

Imagine trading a share of a gold mine in Zimbabwe or staking copper powder from Zambia on-chain — all through a single wallet.

That’s no longer science fiction. It’s already happening.

From Speculation to Sovereignty

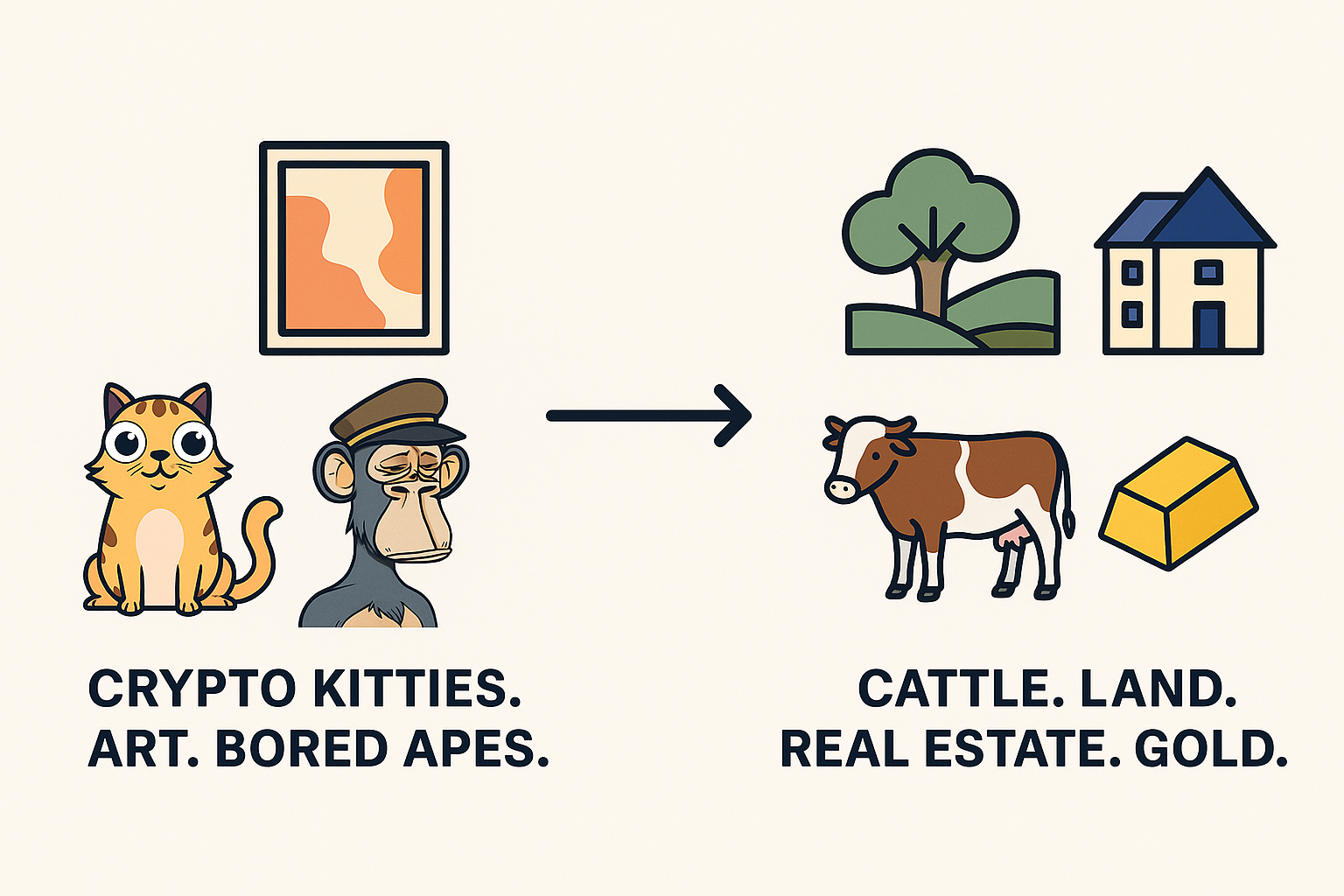

Crypto’s first decade was about memes and momentum.

The next decade belongs to meaning.

Africa isn’t just joining the blockchain movement — it’s redefining it. By tokenizing what’s real, the continent is creating digital institutions where the people own the infrastructure, not the other way around.

That’s what tokenization means here:

Not another coin. A new economic constitution.

Conclusion

The tokenization of real-world assets in Africa isn’t a trend — it’s a tectonic shift. The world’s youngest, most resource-rich continent is building a financial system rooted in transparency, inclusivity, and self-sovereignty.

And when the world catches up, Africa won’t just be participating in the digital economy — it’ll be defining it.

Leave a Reply