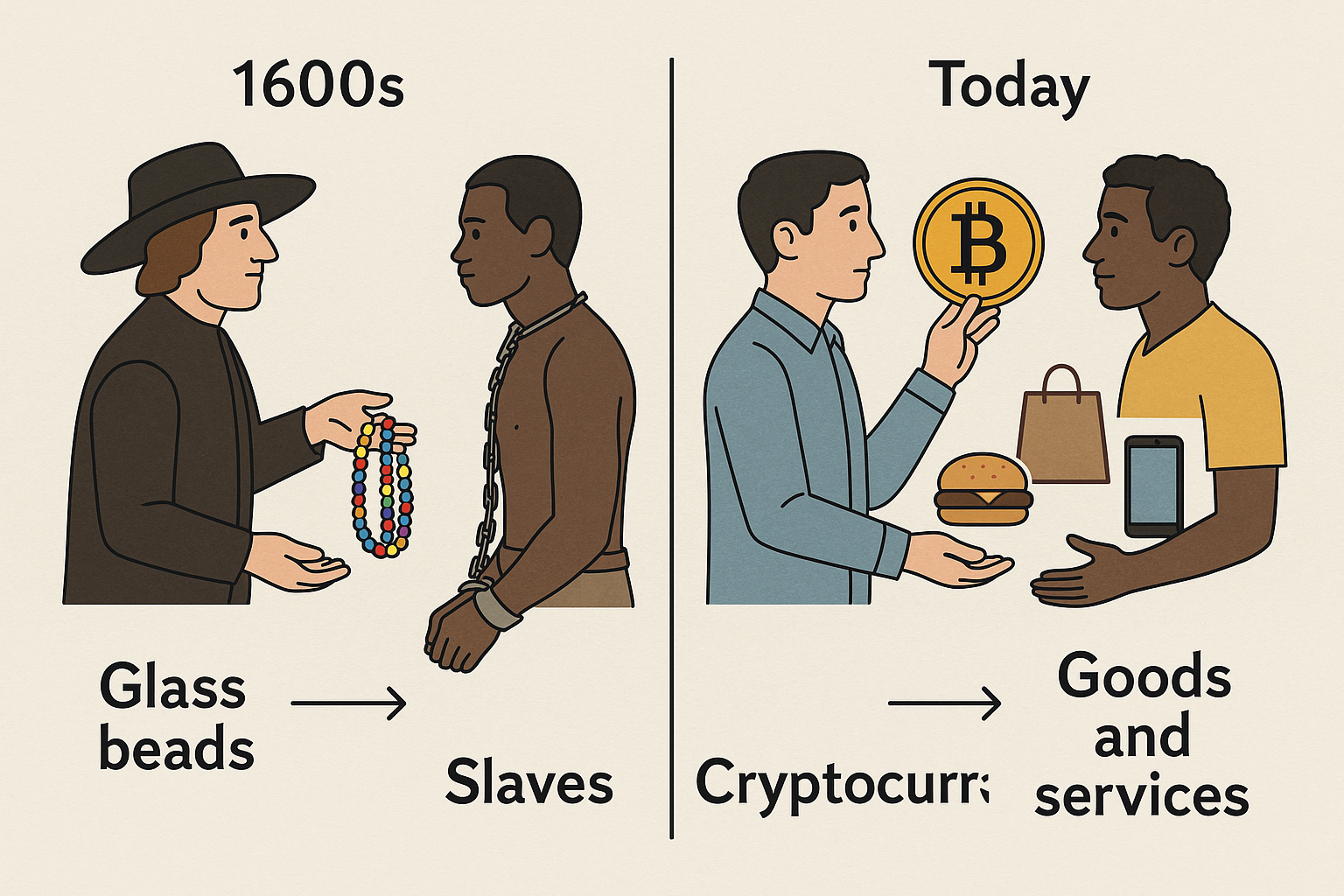

Introduction: Centuries ago, Europeans sailed to the coasts of West Africa with ships full of glass beads made in Holland and Venice. Those beads — beautiful, colorful, and mass-produced — were used to buy Africa’s gold, ivory, and, most tragically, human lives. The Europeans understood something fundamental: value isn’t objective; it’s cultural. They didn’t trade gold for gold — they traded perception for reality.

Today, the same pattern is playing out again — but this time, it’s digital. The beads are no longer glass; they’re tokens on a blockchain.

The New Beads: Tokens Without Substance

Most of today’s crypto projects promise decentralization, empowerment, and financial inclusion. But beneath the marketing gloss, many are just repeating the same colonial logic of extraction — draining value from emerging markets and local economies while selling back speculative hope.

Billions have been raised in “Web3” under the banner of democratization, yet the flows of capital still move in one direction: outward. The coins are mined or minted in the Global South, the liquidity is controlled in the North, and the profits are realized by those who built the rails — not those who supplied the raw economic energy.

The “miners” of today aren’t just people running GPUs; they’re the millions of users providing data, attention, and belief — without realizing that they’ve become the product once again.

Decentralization Without Development

The tragedy is not in the technology — blockchains are powerful tools. The tragedy lies in the architecture of incentives. Most crypto models are built to enrich founders, VCs, and early adopters who exit before the system stabilizes. It’s financial colonialism wrapped in code.

Consider the parallels:

- In the 1600s, glass beads were manufactured cheaply in Europe and exchanged for real African resources.

- In the 2020s, crypto tokens are minted cheaply on Western-funded blockchains and traded for real African liquidity, data, and adoption.

Once again, the “store of value” resides somewhere else. Once again, Africa provides the users, the energy, the story — while others capture the wealth.

The Illusion of Inclusion

Crypto evangelists often talk about inclusion — how “anyone with a smartphone” can join the global economy. But inclusion without ownership is not empowerment. It’s participation in someone else’s system.

When Africans, Latin Americans, or Southeast Asians adopt crypto wallets and stablecoins pegged to the U.S. dollar, they’re still tied to the same monetary hierarchy that devalues their own currencies. The rhetoric of freedom masks the reality of dependency.

If a digital economy doesn’t build local infrastructure — if it doesn’t fund real-world assets, schools, energy, and industry — it’s just another layer of digital colonialism.

Rebuilding the Model: From Extraction to Empowerment

To break the cycle, the next generation of blockchain projects must root themselves in production, not speculation.

That means:

- Tokenizing real assets — gold, copper, solar power, cattle, education — not imaginary yield farms.

- Creating decentralized ownership structures where local communities hold equity, not just utility tokens.

- Reinforcing circular economies where digital value directly funds physical growth.

The goal isn’t just to move money faster — it’s to move power differently.

Conclusion: The Value of Reflection

History has a strange sense of rhythm. The beads have changed, but the pattern remains. Whether it’s glass or code, extraction thrives when people mistake representation for reality.

Africa’s future — and indeed the world’s — depends on learning from that past. We cannot afford another century where we trade our gold for someone else’s glitter.

The revolution will not be tokenized — unless the tokens represent us.

Leave a Reply