The world keeps asking where the next financial infrastructure will come from.

They are looking in boardrooms, whitepapers, and glossy conferences.

They are looking in the wrong place.

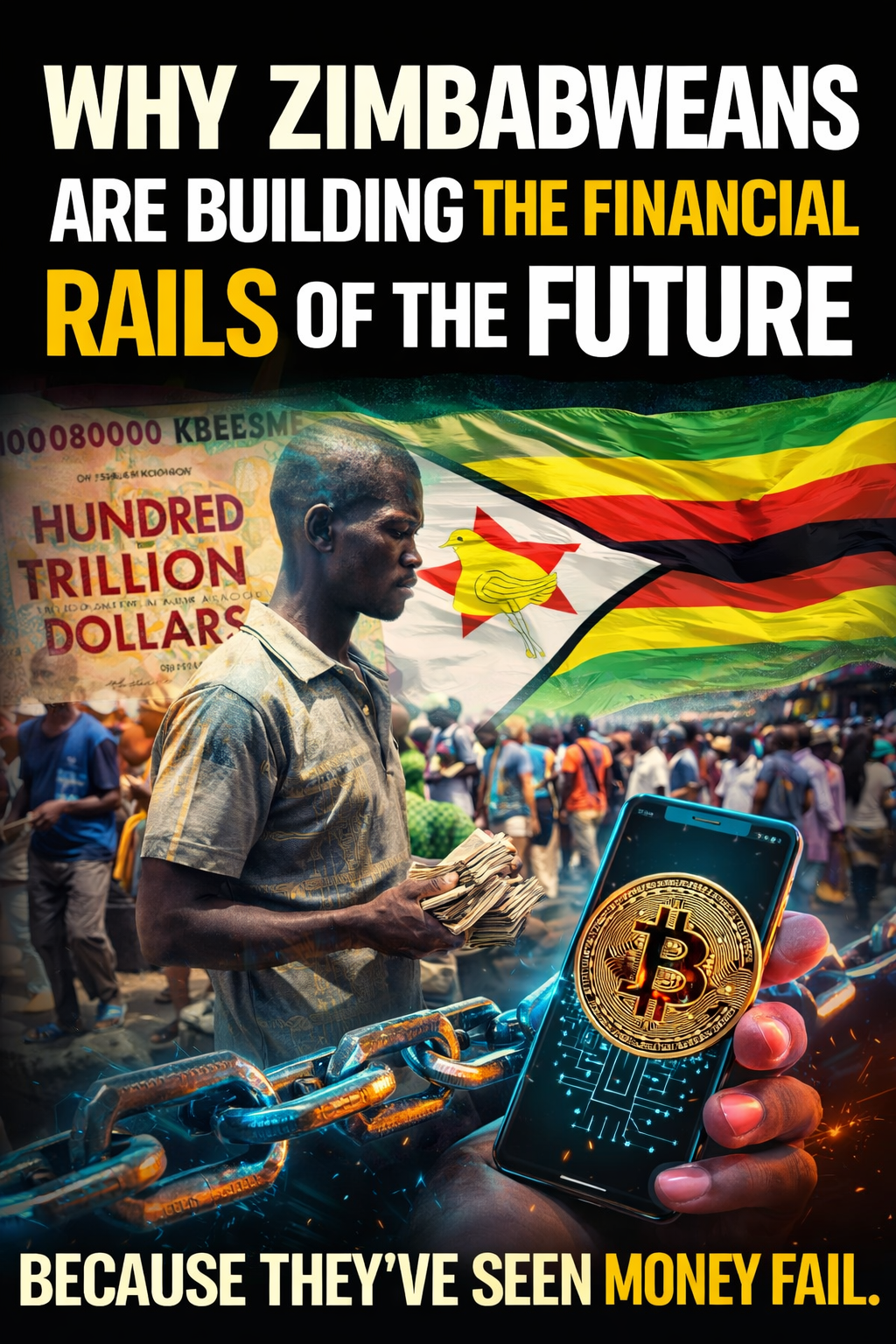

The rails for the future are being built by Zimbabweans who watched money fail in real time and decided it would never be allowed to lie to them again.

When Money Breaks, Illusions Die Fast

Zimbabweans did not debate inflation in theory. They lived it.

They carried trillion dollar notes that could not buy bread. They watched salaries arrive late and leave instantly. They learned, painfully, that money backed by promises is fragile.

That experience burns away fantasy.

Once you have seen a currency collapse, you never confuse rising prices with prosperity again. You never assume institutions will protect you. You stop trusting words and start trusting systems.

This is why Zimbabweans build differently.

Remittances Were the First Signal

Long before fintech made remittances fashionable, Zimbabweans were already dependent on them. When value could not survive locally, it had to arrive from outside.

Money flowed from London, Johannesburg, Toronto, and New York into Harare, Bulawayo, and rural towns. Every transfer exposed the same weaknesses.

High fees. Delays. Arbitrary rules. Forced conversions. Silent value loss.

Remittances taught an entire generation one brutal truth.

If the rails are weak, the value bleeds out before it arrives.

Why Zimbabweans Don’t Trust Editable Money

In stable economies, people assume transactions are final. In Zimbabwe, finality had to be earned.

Balances changed. Rules changed. Limits changed. History was rewritten quietly.

So Zimbabweans started asking better questions.

Can this transaction be altered after it happens?

Can this money be diluted overnight?

Can someone reverse reality with a policy memo?

If the answer is yes, the system is rejected.

This is why immutability matters more than marketing.

From Survival to Architecture

What outsiders miss is that Zimbabweans are not just users of new financial systems. They are architects.

They design for failure first.

They assume volatility.

They assume interference.

They assume pressure.

That mindset produces stronger rails.

Rails that do not rely on trust.

Rails that settle cleanly.

Rails that remember every transaction exactly as it happened.

When someone has already lived through monetary collapse, they do not need to be convinced. They need tools that work.

The Quiet Advantage No One Talks About

Here is the uncomfortable truth.

Countries that never experienced currency failure still believe money is permanent. Countries that survived it understand money is a technology.

Zimbabweans are building systems that behave like infrastructure, not promises.

They are building wallets, settlement layers, and transfer rails because they already know where weak systems break. They already know how people adapt under pressure.

Pain turned into pattern recognition.

Pattern recognition turned into design.

The Future Is Being Built by the Previously Burned

The next global financial rails will not be built by people who trust the system.

They will be built by people who had to replace it.

Zimbabweans do not build for hype cycles. They build for the next crisis because they know one always comes.

They are not chasing the future.

They are preventing the past from happening again.

And that is why the rails of tomorrow are being laid by those who once watched money disappear and decided it never should.

Leave a Reply