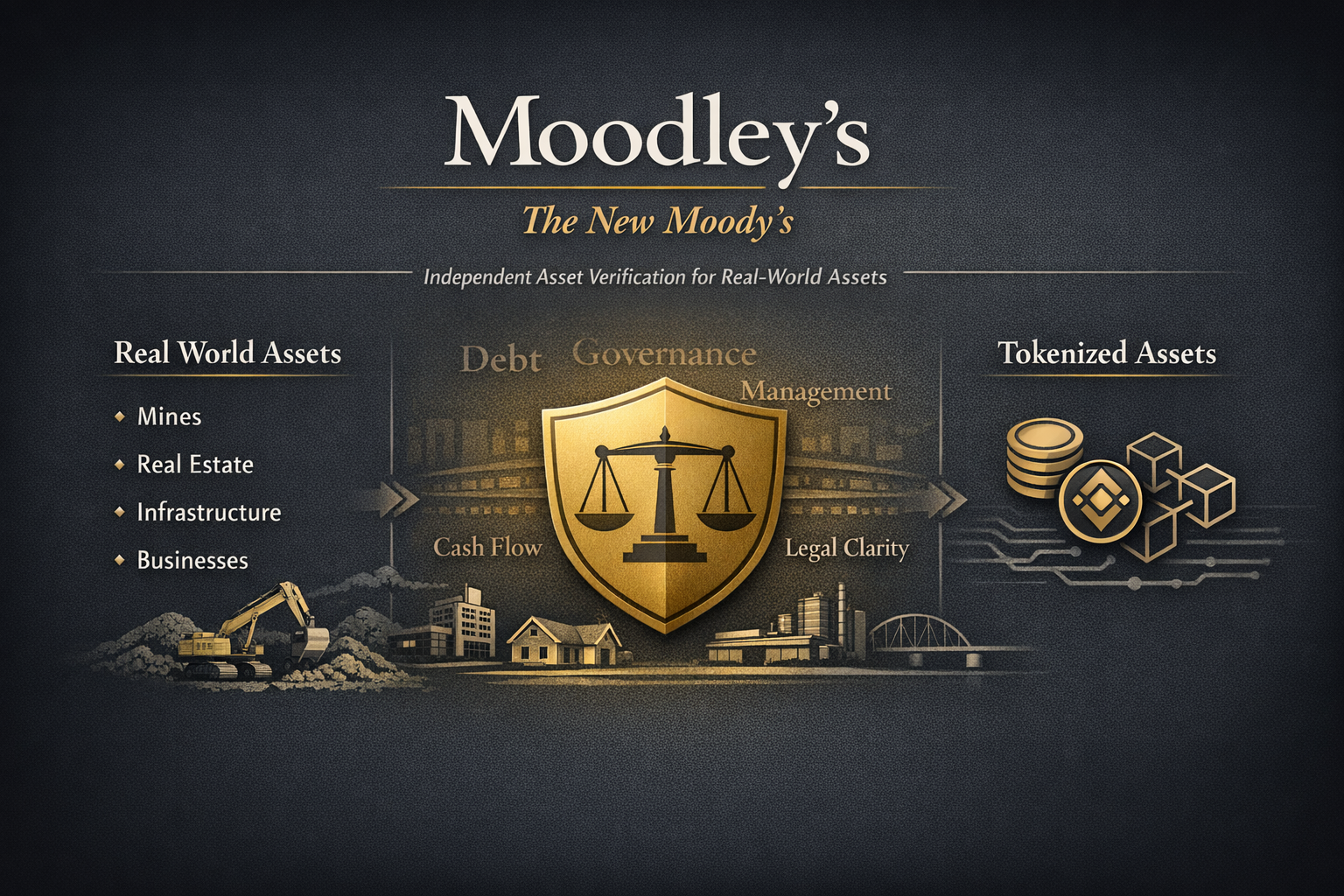

Why Moodley’s Is Becoming the “Moody’s of Real World Assets”

Tokenization is everywhere.

Real estate tokens. Gold tokens. Mining tokens. Infrastructure tokens. Even revenue share tokens backed by “future growth.”

But here is the uncomfortable truth most platforms will not say out loud.

Tokenization does not create value. It only moves value faster.

And if the underlying asset is bad, tokenization just accelerates the spread of risk.

The Fatal Flaw in Today’s RWA Boom

The Real World Asset sector is exploding because it promises liquidity, access, and global participation. What it quietly ignores is the most important question in finance.

Is the asset actually worth anything?

An asset can look impressive on paper and still be worthless in reality.

Hidden debt

Weak governance

Bad management

Fabricated cash flow

Legal ambiguity

No enforcement mechanisms

Once that asset is tokenized, those problems do not disappear. They become harder to unwind.

This is the missing middle of tokenization.

Between the real world and the blockchain, there must be an independent filter that says yes or no before capital arrives.

What Traditional Finance Already Figured Out

Traditional capital markets solved this problem decades ago.

That role belongs to Moody’s.

Moody’s does not sell investments.

It does not manage portfolios.

It evaluates risk.

Its job is brutally simple. Assess the likelihood that an asset, company, or government will fail.

That assessment determines who can invest, how much capital flows in, and at what cost. Entire pension funds, insurers, and banks are legally bound by these ratings. A single downgrade can raise borrowing costs overnight or shut off capital completely.

Moody’s is not powerful because it predicts the future perfectly. It is powerful because the financial system agreed that independent risk judgment is infrastructure.

Tokenization skipped this step.

The RWA Industry’s Trust Problem

Most RWA platforms operate like marketplaces, not gatekeepers.

If it looks interesting, it gets listed.

If it has a good pitch deck, it gets tokenized.

If liquidity shows up, scrutiny comes later.

That model works until it does not.

When misrepresentation scales faster than due diligence, trust collapses. History has shown this repeatedly, from mortgage backed securities to speculative bubbles dressed up as innovation.

The blockchain does not fix this. It amplifies it.

Why Moodley’s Exists

Moodley’s was built to solve the problem everyone else avoids.

Moodley’s is not a launchpad.

It is not optimized for volume.

It is not designed to list everything.

It is designed to say no.

Assets do not reach the chain unless they pass rigorous financial, operational, and governance audits. If the asset is overleveraged, poorly managed, legally compromised, or structurally unsound, it does not get tokenized. Period.

In that sense, Moodley’s functions as a Moody’s-like gatekeeper for real world assets before they become digital liabilities.

Why This Matters More Than Ever

As RWAs scale, the biggest risk is not volatility.

It is misrepresentation at scale.

Bad assets wrapped in good narratives move faster on-chain than they ever could in traditional markets. Without an independent audit layer, tokenization becomes a distribution mechanism for hidden risk.

The future winners in the RWA space will not be the loudest platforms or the fastest movers.

They will be the ones that said no most often.

Gatekeeping is unfashionable.

But trust compounds.

The Bottom Line

Markets do not collapse because innovation moves too slowly.

They collapse because risk moves faster than scrutiny.

Tokenization is inevitable.

Unfiltered tokenization is dangerous.

Moodley’s exists to slow risk down before code speeds it up.

And that is why people are starting to say it quietly first, then out loud.

Moodley’s is the new Moody’s.

Leave a Reply